Valuation of an SME using the DCF method

Step by step

In September 2018, EXPERTsuisse published the revised technical note “Business Valuation of Small and Medium-sized Enterprises (SMEs)”. The new technical bulletin deals explicitly with the valuation of SMEs and provides concrete recommendations on how to take into account the special features of small and medium-sized enterprises. Future-oriented valuation methods are recommended, above all the discounted cash flow (DCF) method.

The aim of this article is to demonstrate the application of the DCF method by means of a practical example, taking into account the recommendations of the new technical communication. The focus is on the correct derivation of the free cash flows, the determination of the cost of capital and the derivation of the residual value.

DCF method at a glance

The DCF method determines the value of a company or its shares as the present value of the cash flows that will accrue to the investors in the future. In contrast to profit, which forms the basis of the capitalised earnings value method, non-cash transactions such as depreciation or book profits are not reflected in the cash flow. On the other hand, cash flows from investment activities and the capital tied up in net current assets are taken into account in the free cash flow.

In principle, a DCF valuation can be carried out on an entity or equity basis. With the former, the valuation is carried out at total capital level, i.e. the free cash flows due to both debt and equity providers are relevant and are discounted to the valuation date using the weighted average cost of capital (WACC). In the equity method, only the free cash flows due to the equity providers (i.e. after any repayments or borrowings) are taken into account and discounted with the cost of equity. In practice, the entity approach is clearly predominant and is preferred by the technical communication, which is why only this approach is dealt with in this article.

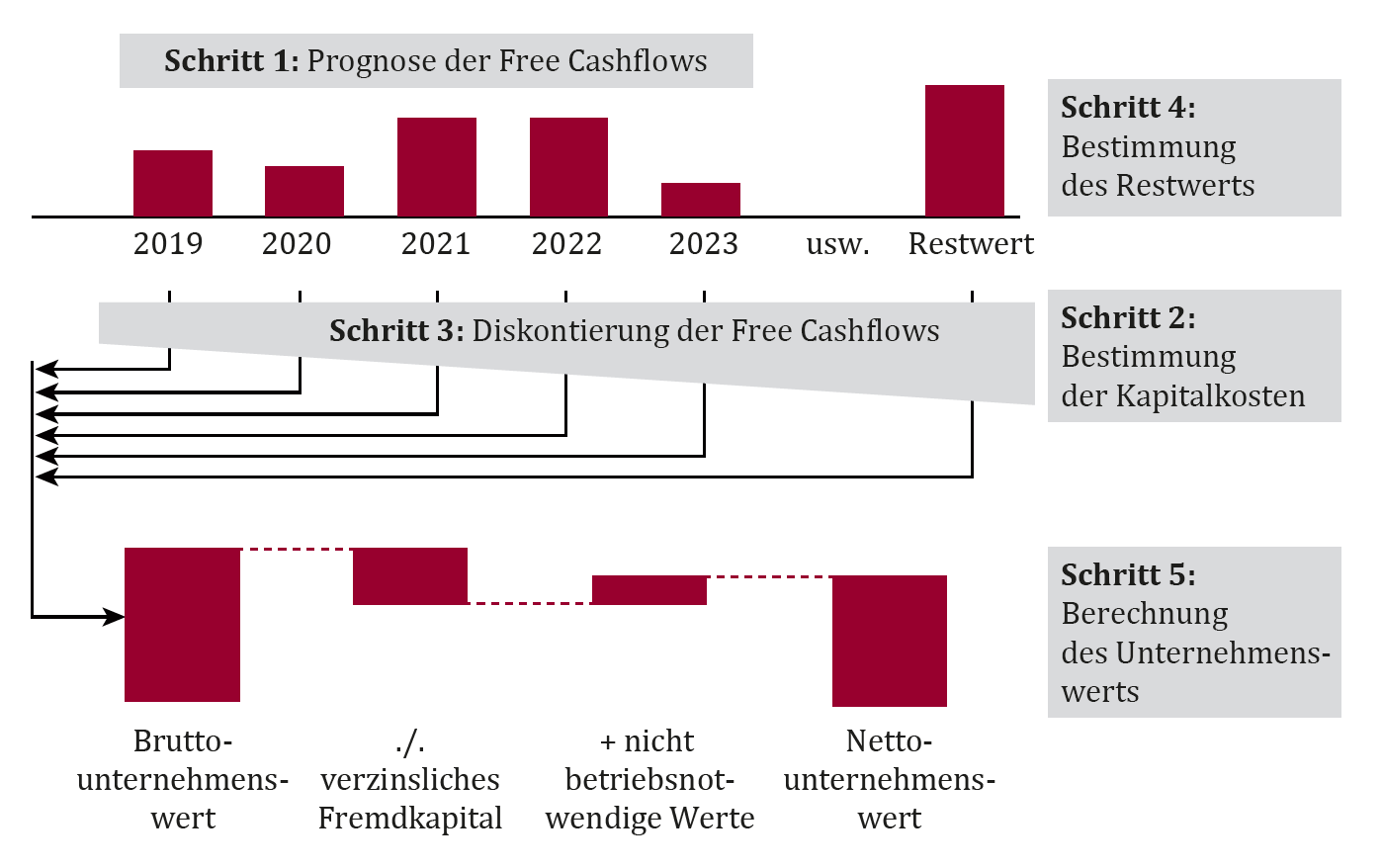

A DCF valuation can basically be divided into five steps.

Step 1: Forecasting free cash flows

The first step is to forecast future free cash flows. These are usually not estimated directly, but derived from a budgeted balance sheet and budgeted income statement. This is preceded by a clean preparation or adjustment of the last three to five years so that the forecast can be based on a past that is as undistorted and normalised as possible.

Step 2: Determining the cost of capital

Once the free cash flows have been forecast for the next three to five years (detailed planning period), a risk-adjusted cost of capital must be determined that expresses the return expectations of the providers of capital and matches the free cash flows (= consistency). Since the free cash flows are, by definition, due to both debt and equity investors, a weighted average cost of capital (WACC) must be determined.

Step 3: Discounting the free cash flows

In the third step, the individual free cash flows are discounted to the valuation date using the WACC. The logic here is that a future free cash flow has less value from today’s perspective the further it lies in the future. By discounting the free cash flows that occur at different points in time, they can be compared and added together.

Step 4: Determination of the residual value

The determination of the residual value (also called terminal value) is of particular importance. Since a business valuation typically assumes a perpetual life, the residual value summarises all expected free cash flows after the last detailed planning year in the form of a perpetual annuity (capitalised future free cash flows). It is also necessary to make an assumption about the expected long-term growth rate.

Step 5: Calculation of the enterprise value

The present values of the free cash flows of the detailed planning period and the present value of the residual value add up to the gross enterprise value. In order to obtain the net enterprise value or the value of the equity (or share value), the interest-bearing debt capital must be subtracted as of the valuation date, and any assets not required for operations must be added.

Read the full article from the Jahrbuch Treuhand und Revision 2019 (in German) here.