Disrupted or discounted cash flow?

Digitalisation and business valuation

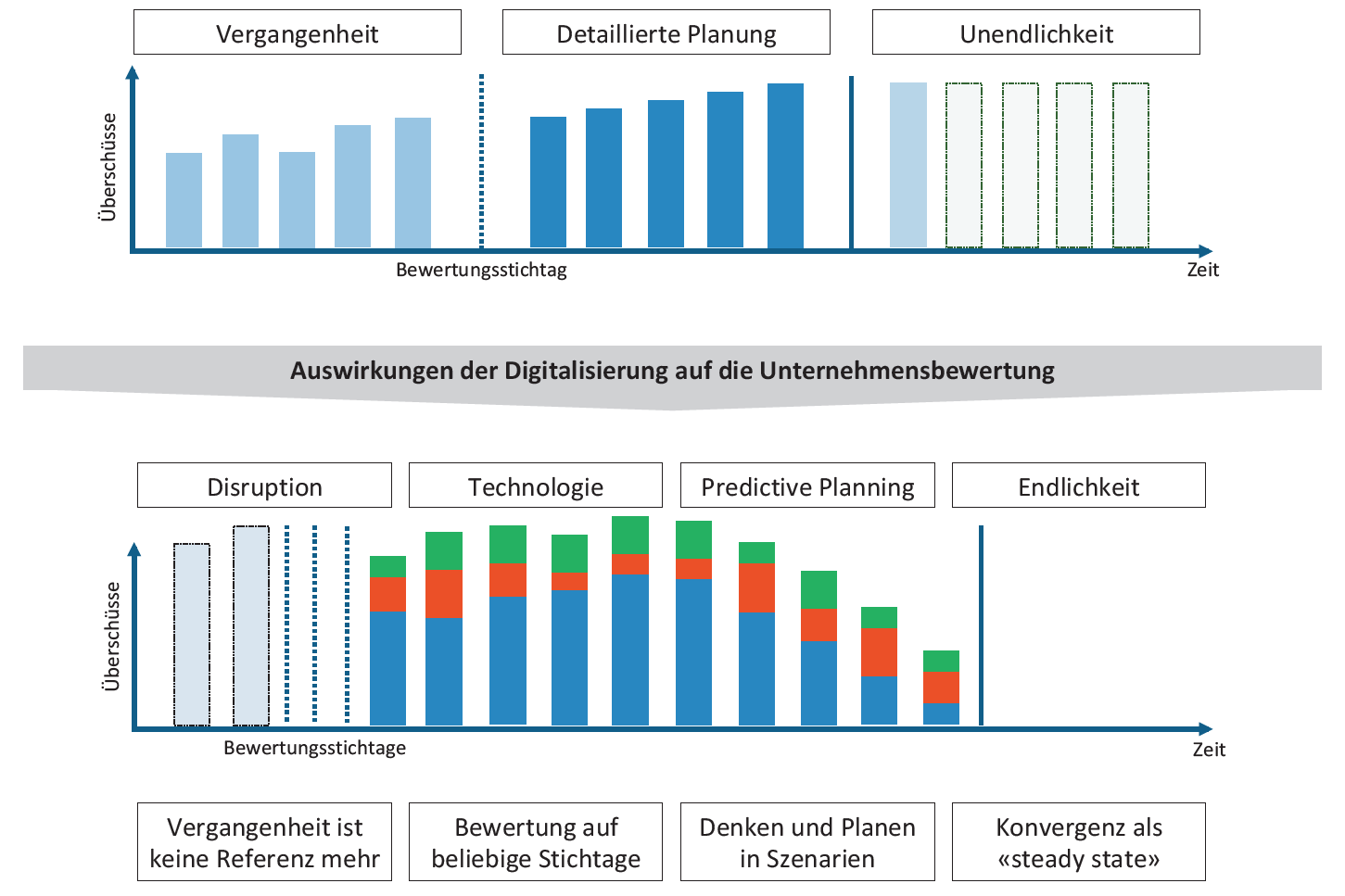

Digitalisation knows winners and losers. Traditional companies are coming under the hooves of young and highly valued “unicorns”. Risks and opportunities are growing and the unexpected must be expected. This also has an impact on company valuations.

The fact that digitalisation will change many things is currently the common narrative of every seminar, technical paper or New Year’s speech. However, opinions differ on the “what” and “when”. Becoming and remaining “digital” requires investments whose return on investment (ROI) often remains vague. This uncertainty is actually poison for a company valuation that relies on predictable cash flows, fixed capital structures and the “steady state”. However, as with any poison, it all depends on the dose. Digitalisation does not make a company valuation superfluous, but traditional approaches should be reconsidered.

Tools instead of intuition

Whether digital or analogue: In the future, too, companies will be interpreted by the doctrine as a source of income and their value will be determined by the financial surpluses accruing to the investor. And basically, business valuation is quite simple, it needs a number (cash flow), a time (planning time) and an interest rate (cost of capital). Even if this comes in different guises (e.g. DCF or capitalised earnings value models or multiples), the same calculation is always behind it.

With digitalisation, the tangible assets of companies are becoming less and less relevant for valuation. Substance-oriented methods – such as the practical method – are being marginalised. Since different future performance methods with the same assumptions must lead to the same results, the question of the appropriate valuation method is in the end only a question of the preferred presentation in each case.

To outsiders, discussions around these assumptions sometimes resemble “voodoo”. In fact, however, there is a broad consensus on what is customary. After all, the professions in Germany, Austria and recently also in Switzerland have created standards that provide a stable framework for business valuations.

In the future, company valuation will therefore be neither art nor science, but a craft. This does not require intuition, but experience and good tools. Digital valuation tools beyond Excel will therefore gain in importance. These will relieve valuers of error-prone and time-consuming modelling work, leaving more time for the actually valuable activities in the literal sense of the word: The analysis of the business model, the identification of value drivers and thinking in scenarios.

Read the full article from the trade magazine rechnungswesen & controlling 4|2018 (in German) here.