1. Enter basic data

Collection of quantitative and qualitative information on the business- √ Upload actual figures (balance sheet and income statement) from Excel or enter them online

- √ Optionally, detailed information on the company (company profile, products and sales markets, ownership, etc.) and the valuation assignment can be entered

wevalue uses the actual figures as a basis for planning and valuation. Information on the company and the valuation assignment are included in the expert opinion.

2. Adjust actual figures

Adjustment of the actual figures to create a clean basis for the preparation of the planning- √ Hidden reserves

- √ Non-operating assets

- √ Normalisation of the income statement (e.g. adjustment of the managing director's salary to a normal market level)

wevalue transfers from the external to the internal financial statements on the basis of the adjusted actual figures.

3. Determine cost of capital

Determination of the cost of capital using current market data- √ Derivation of beta and multiples from comparable companies (peer group) or industries

- √ Determination of the (target) capital structure

- √ Customised assumptions on the cost of equity and debt (e.g. level of market risk premium)

wevalue calculates the cost of equity and total capital (WACC) on the basis of your information according to established theory and common practice.

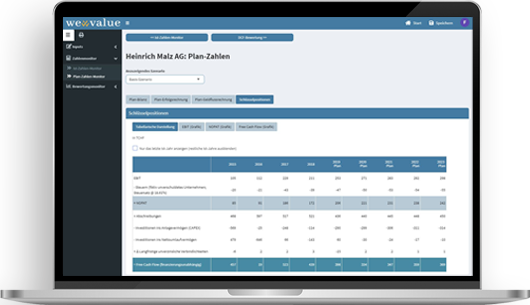

4. Derive plan figures

Planning future financial years on the basis of the adjusted actual figures- √ Detailed planning period parameters can be selected as desired, providing complete flexibility

- √ Plan figures can be automatically generated, customised, or entered manually

- √ Unlimited number of scenarios

- √ Multiple models to choose from for derivation of the terminal value (perpetual growth, value driver model, exit multiple, liquidation value)

wevalue provides you with a fully integrated financial plan (budgeted income statement, budgeted balance sheet and budgeted cash flow statement) and derives the free cash flows from it.

5. Valuation of the business

Valuation of businesses by means of various established methods- √ Discounted Cash Flow Method (DCF method)

- √ Multiplier method (multiples method)

- √ Practitioner's method (combination of net asset value and capitalised earnings value)

wevalue determines the enterprise value on the basis of your information, calculates sensitivities and graphically displays the value ranges.

6. Generate reports

One-click creation of the formulated valuation report- √ Transparent and clearly documented derivation of the enterprise value

- √ Information entered in the tool automatically populates the report

wevalue provides you with the valuation report in a practical Excel and PowerPoint format. This allows you to customise and individualise the appraisal as you wish.