Pragmatic, practically, good

DCF valuation of SMEs

DCF methods are considered “best practice”, practitioner methods “most practiced”. The authors deal with both methods. A DCF method is presented that is adapted to the special features of SMEs, is theoretically supported and can be implemented in practice.

Technical communication provides for DCF method as “best practice”

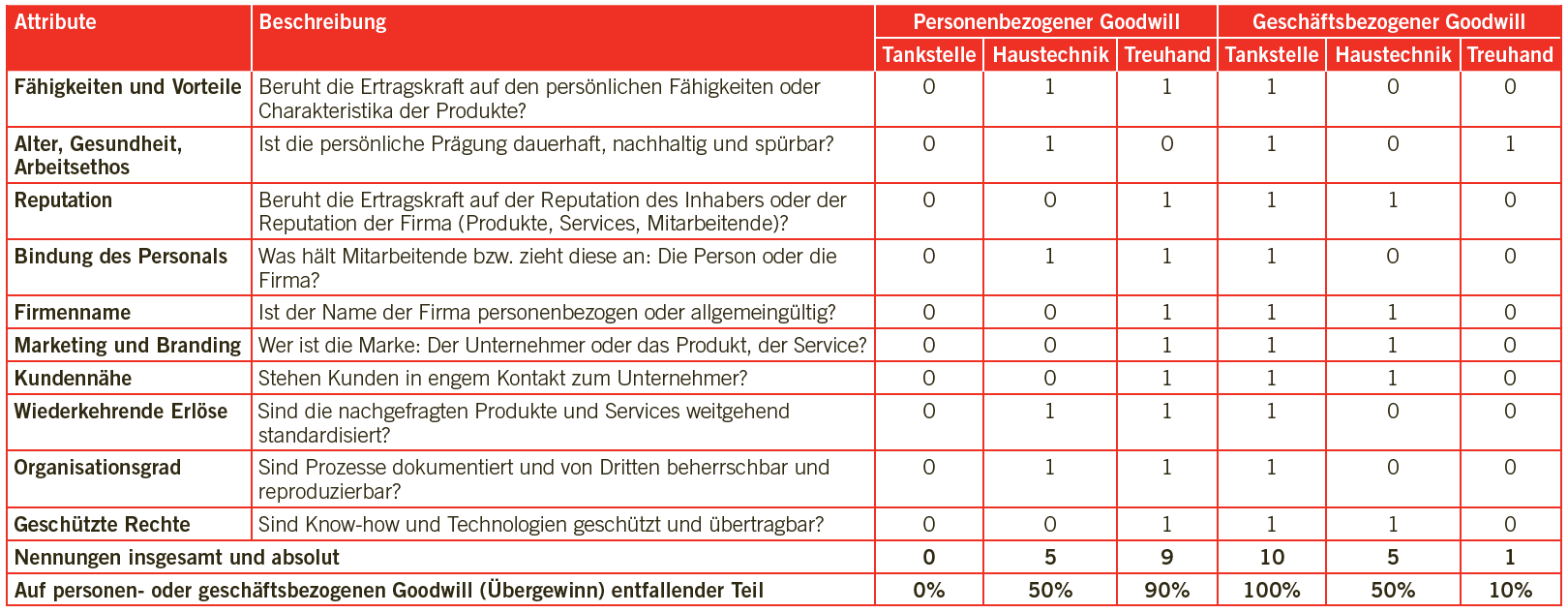

The revised and recently published “Fachmitteilung Unternehmensbewertung von KMU” of EXPERTsuisse (FM 2018) provides for the discounted cash flow (DCF) method as “best practice”. DCF methods sometimes have a difficult time in the SME environment. The main fears are problems with practical implementation and acceptance of the results: The calculation models are complex, the assumptions unrealistic and the results notoriously too high. After all, the practitioner method is a proven approach that is accepted by the courts and widely used in practice. This article addresses these arguments. First, the practical method is critically assessed. Then, a DCF model is developed that is in line with the FM 2018 and takes into account the special features of SMEs as well as the concrete data situation.

Appraisal of the practitioner procedures

Practical methods – i.e. a mixture of net asset value and capitalised earnings value – have developed from the sales practice for developed properties. In valuation theory, these combination methods were advocated by Jakob Viel (Zurich), Otto Bredt (Hanover) and Maurice Rendard (Paris), among others. Together with Otto Hax (Frankfurt) and on behalf of the Union Européenne des Experts Comptables, Économiques et Financiers (UEC), they published this method for the first time in 1961 in a closed presentation. The henceforth so-called “UEC method” was in fact the first business valuation standard for auditors.

The UEC is history – it was dissolved in 1986 – and the “UEC method” has also no longer been advocated in this form since 1967. At present – as far as can be seen – no one in valuation theory stands up for the theoretical correctness of the practical method. Although individual aspects – substance-related success, capital commitment, excess profits and their threat from competitors – are well recognised, their methodical linking in a formula is doubtful.

Read the full article from TREX – Der Treuhandexperte 2|2019 here (in German).