Special features of the valuation of micro-enterprises

Many questions – some answers

Emotions run high and budgets low when valuing micro-enterprises and sole proprietorships. But here, too, the approach must be serious and appropriate, and the results should be defensible. This article addresses essential questions and provides answers.

Introduction

Micro or small enterprises are the most common form of SME in Switzerland: nearly 90% of all enterprises employ fewer than 10 people. When evaluating companies of this size, emotions are often greater than the budgets available. Negotiations about the price then quickly replace any methodical discussion about a company valuation.

However, “pricing” rather than “valuation” only serves the parties if they agree or have to agree, as is the case in a real sale. The situation is different in the case of dominated valuation occasions: In the case of divorce or inheritance disputes, a fair agreement must also be found for parties who are facing each other with different lengths of spikes.

In such legally required valuations, it is almost always a matter of estimating a “market value”. According to the Federal Supreme Court, this is “the value that could normally be achieved in the course of a sale in the ordinary course of business. The decisive factor is therefore a technical or legal-objective approach and not a subjective-economic approach”. Thus, an area of agreement must be assumed, a price determination must be simulated.

Trustees and advisors often act as arbitrators here and are supposed to estimate a value mediated between the two sides (arbitration value). This must be done impartially and thus without taking into account the concrete personal – i.e. subjective – circumstances. Assumptions are therefore necessary. In valuation theory this is also called objectifying valuation. This is so interesting and challenging because here “the entire … keyboard of scientific knowledge is drawn upon” (cf. Wollny, 2018, p. 54). This sometimes leads to irritation in the pragmatically working SME world.

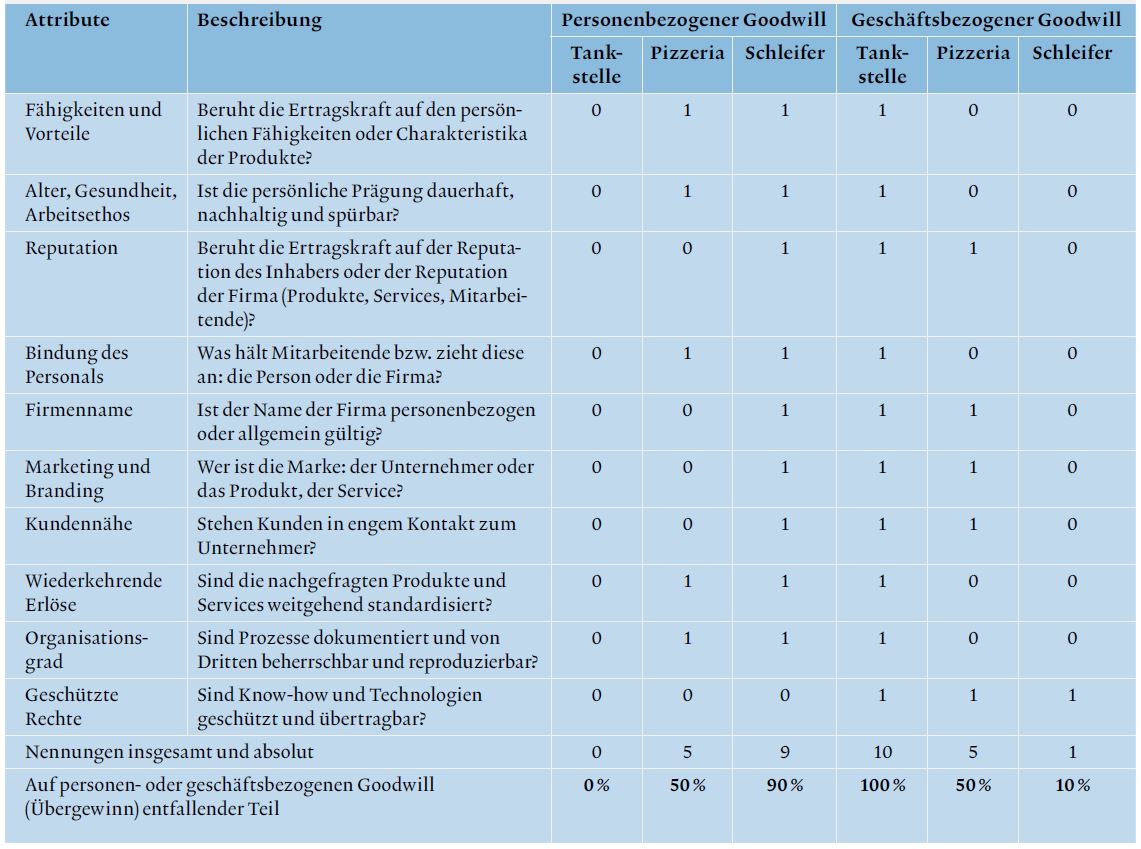

In the following, the authors start from the ideal of the legally required estimate of the market value of a micro-enterprise run as a sole proprietorship, for example in the event of a divorce. In this situation, answers that are as defensible and court-proof as possible must be found for all questions. Simplifications and shortcuts for deviating cases of application will then be found by valuation practice on its own. Methodologically, the authors assume best practice, i.e. a valuation with a DCF method. Of course, this does not exclude other methods – the practitioner method or multiples. However, the authors are convinced that a transparent and thus also communicable valuation is best achieved with a DCF method. If other methods are used, it must nevertheless be possible to answer the questions raised.

Read the full article from EXPERT FOCUS October|2021 here (in German).