Determining the cost of capital in practice

How the cost of capital can also be systematically derived for SMEs

This article shows how the cost of capital – especially the cost of equity – can be estimated systematically and in a market-based manner for SMEs. The proposed methods are theoretically supported, are based on common practice and are in accordance with the recently revised Expertsuisse publication “Business Valuation of SMEs”.

Introduction

The cost of capital is one of the key variables in any business valuation, not least for SMEs. They are needed to discount the free cash flows to the valuation date. In principle, the cost of capital can be estimated subjectively or derived as a model from market data.

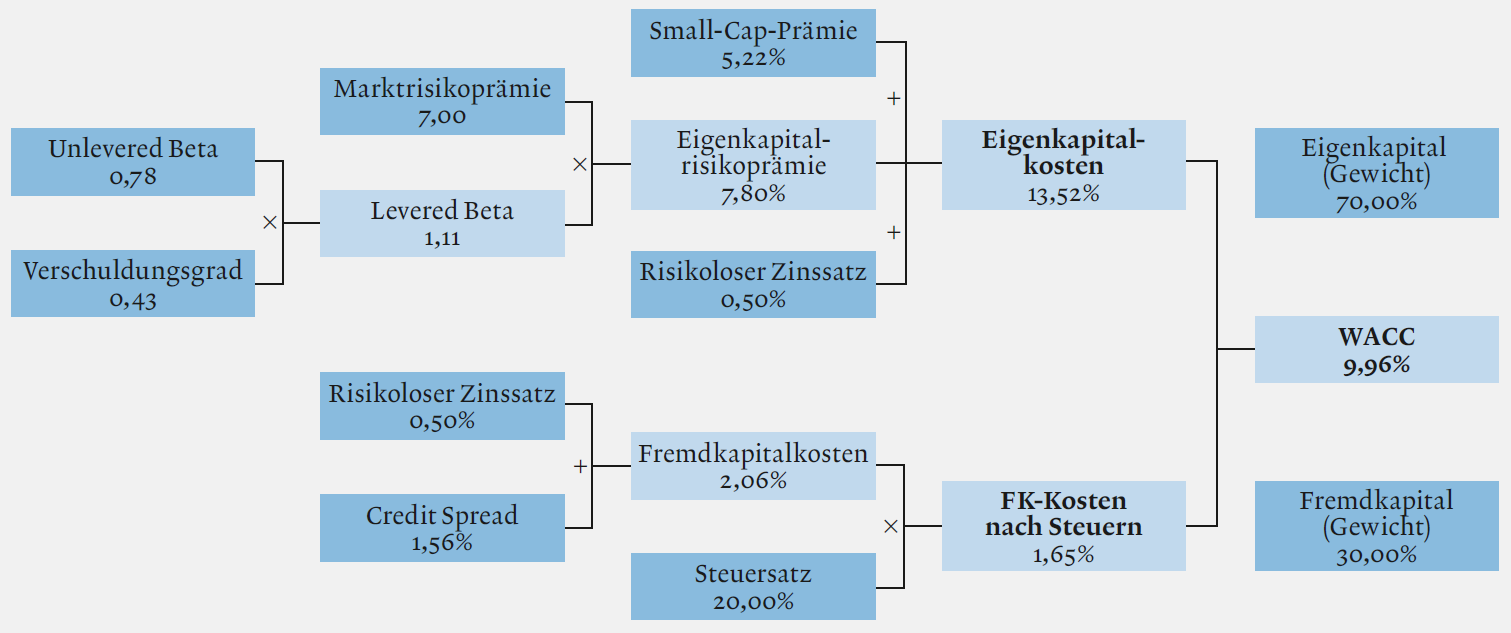

Typically, company valuations, especially when using the discounted cash flow (DCF) method, are carried out on an entity basis. This means that free cash flows are forecast that are due to debt and equity investors, i.e. before any financing costs. The cost of capital must therefore compensate for the risk of the debt and equity providers, i.e. it must be a mixed rate, the so-called WACC (Weighted Average Cost of Capital).

The derivation of the cost of capital sometimes reminds outsiders of “voodoo”. It is sometimes doubted that capital market theory can lead to useful insights for a company that is not oriented to the capital market, such as an SME. This is where this article

starts here.

Step by step, the derivation of the cost of equity, the cost of debt and the WACC are explained and suitable sources for SME valuations as well as current capital market data are presented.

Read the full article from EXPERT FOCUS 2019|4 here (in German).