Special features of the valuation of small and medium-sized enterprises (SMEs)

The following article highlights the special features of the valuation of small and medium-sized enterprises and presents the professional opinions on the valuation of SMEs in the DACH region. It also shows how the essential particularities of SMEs can be taken into account in the valuation.

Definition SME

Small and medium-sized enterprises (SMEs) can be described and delimited quantitatively and qualitatively. As far as accounting, auditing or promotion issues are concerned, a quantitative classification is usually used. According to EU Recommendation 2003/361, companies with fewer than 250 employees and an annual turnover of up to € 50 million or a balance sheet total of no more than € 43 million are considered SMEs. At least with regard to the number of employees, this also corresponds to the national thresholds in Germany, Austria and Switzerland. With regard to balance sheet total and turnover, however, the definitions there diverge.

No special valuation procedures for SMEs

As far as the valuation of SMEs is concerned, their turnover and balance sheet total may be relevant for the result of the valuation, but not for the procedure. There are no special valuation procedures for SMEs, but their special features must be taken into account in the valuation. Even companies that qualify as “large” for accounting purposes may have SME-typical characteristics, which must then be taken into account accordingly.

Strong personalisation

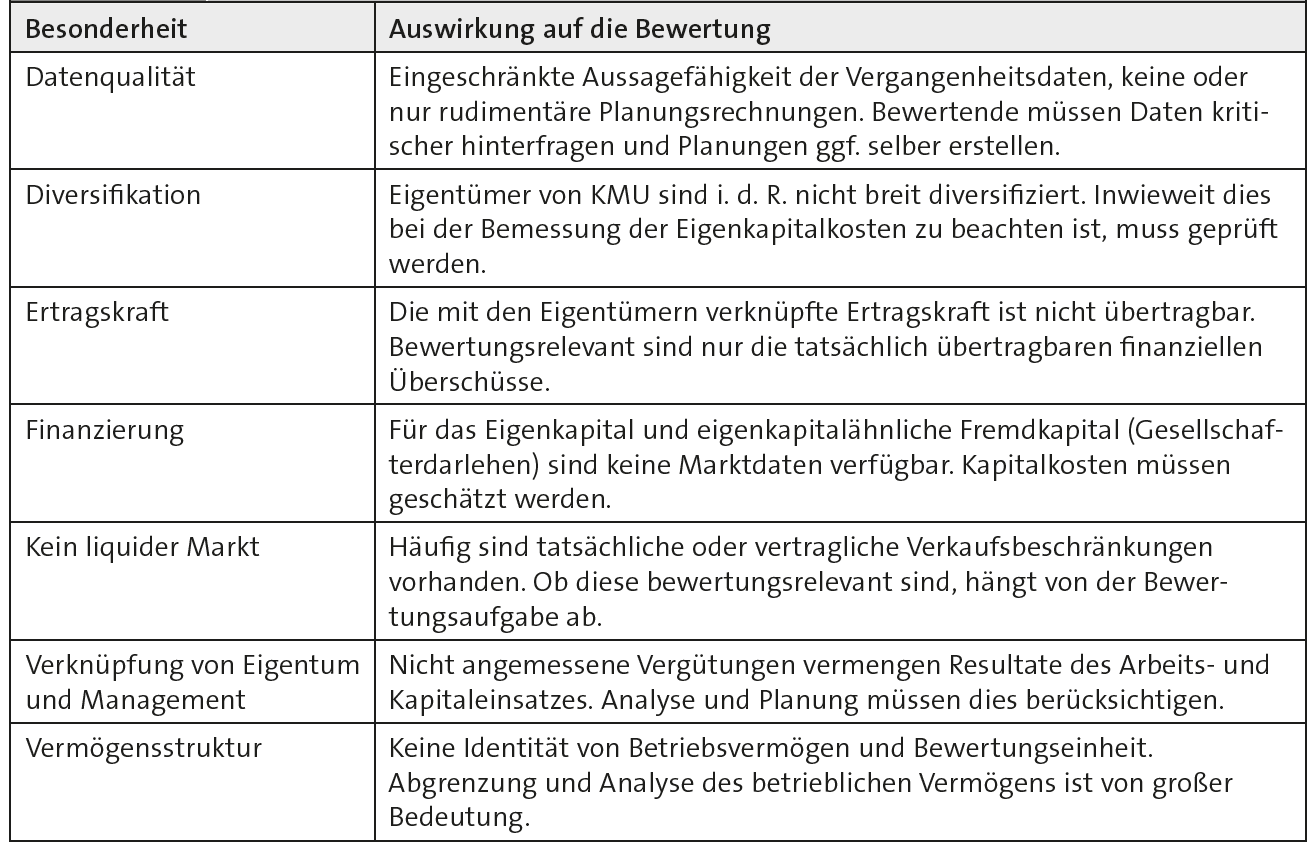

Typical of SMEs is the special personal nature of the enterprises. This relates to the asset structure (differentiation between business and private assets, taking into account hidden reserves), financing (no access to an organised capital market and preferential self-financing) and, in particular, the earnings power, which is often only transferable to a limited extent. The link between ownership and management should also be emphasised, as well as the lower data quality compared to large companies. Finally, it should be noted that micro-enterprises in particular are often run as sole proprietorships, whose figures are more tax-driven than those of corporations. Another characteristic is that there is no liquid market for shares in SMEs.

Read the full article from the Praxishandbuch der Unternehmensbewertung 7th edition 2019 (in German) here.