Business Valuation Update

The latest developments in business valuation theory, practice and case law

In business valuations, theory and practice, economists and lawyers meet. This creates dynamics in valuation theory, practice and jurisprudence. The “Business Valuation Update” reports on current developments.

Introduction

Companies and the way they generate value are subject to constant change. This also applies to their valuation (how high is the value?), their assessment (how fair is the value?) and their distribution (to whom does the value belong?). Valuation theory, valuation practice and case law reflect this change. The “Update Business Valuation” presents current developments in these three areas that are significant for professional practice.

Developments in valuation theory

Valuation theory is difficult to locate as a discipline. The scholars involved in the discussion are predominantly economists and lawyers who belong to different communities of thought. This in itself makes it difficult to determine where one stands. It does not get any easier if one looks at the economists separately, since some work closely on financial accounting, while others tend more towards statistics, econometrics and mathematics.

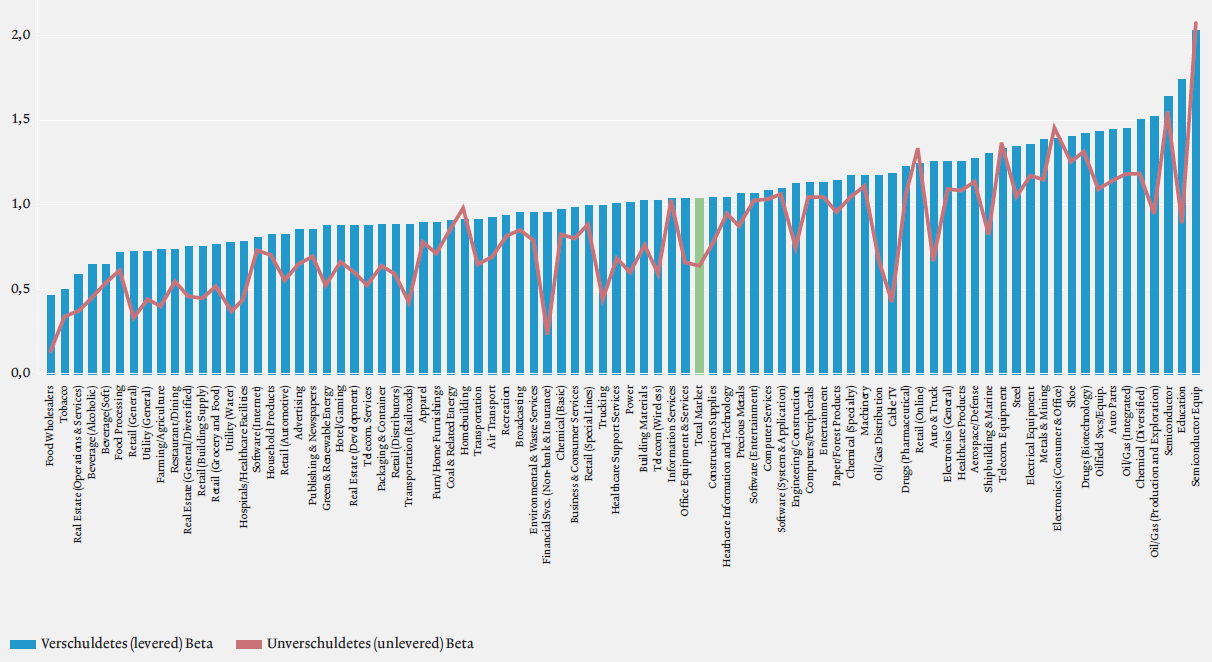

No matter from which direction impulses may come, it is not a matter of always bringing new models into the world, but of adapting the existing models to a new world. Valuation theory is therefore always concerned with phenomena that can be experienced in practice. Currently, three topics in particular are being discussed: Market risk premium in the low interest rate environment, determination of beta factors and debt beta.

Read the full article from EXPERT FOCUS 2019|6-7 (in German) here.