Valuation of an SME using DCF

Five steps to the goal

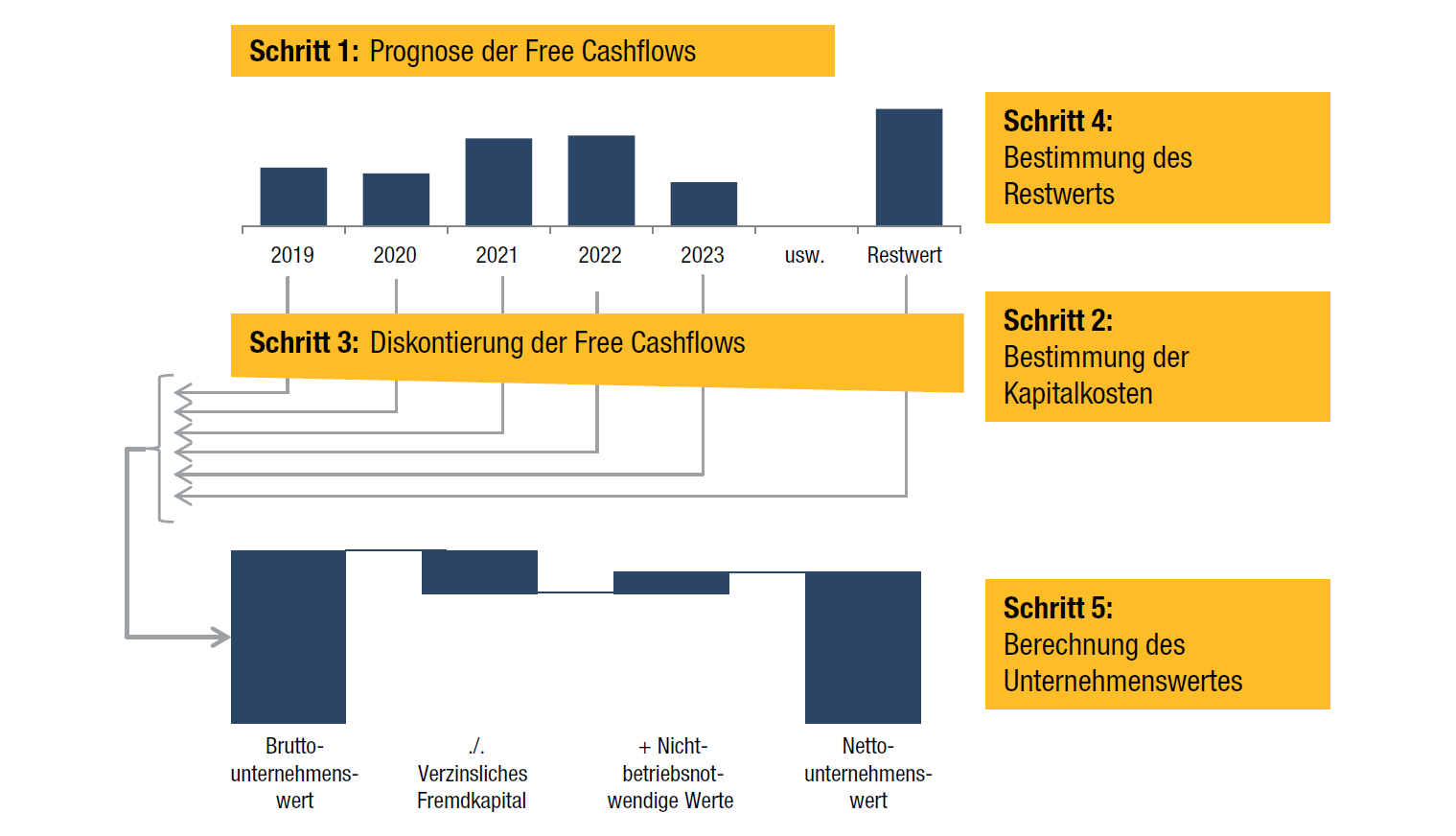

The 2018 revision of the technical bulletin “Business Valuation of SMEs” also provides for the DCF method for the valuation of small and medium-sized enterprises. The following article presents an overview of the five steps and provides concrete recommendations for action.

Future cash flows are crucial

In contrast to the capitalised earnings method, the DCF method determines the value of a company on the basis of future cash flows and not profits. This has the advantage that investments and capital commitments in fixed and net current assets are explicitly taken into account. Since free cash flows are proportionately due to both debt and equity investors, they must also be discounted with a cost of capital that reflects the return expectations of both investor groups, the so-called WACC. Particular attention is paid to the residual value, which can often account for significantly more than 50% of the enterprise value. The sum of the present values of the free cash flows and the residual value results in the gross entity value, from which the financial liabilities have to be subtracted and any non-operating assets (e.g. surplus cash) have to be added to obtain the net entity value (equity value).

Read the full article from the TREUHAND kompakt newsletter 7|2019 here (in German).