Update Business Valuation 2020

The latest developments in business valuation theory, practice and case law

In business valuations, theory and practice, economists and lawyers meet. This ensures dynamism in valuation theory, practice and jurisprudence. The Business Valuation Update reports annually on current developments.

Introduction

Companies and the way they generate value are subject to constant change. This also applies to their valuation (how high is the value?), their assessment (how fair is the value?) and their distribution (to whom does the value belong?). Valuation theory, valuation practice and case law reflect this change. Our Business Valuation Update regularly presents current developments that are significant for professional practice. In view of the importance of the topic of corona, we devote a separate article to it in this issue.

Developments in valuation theory

Beyond the horizon it goes on – if so, how?

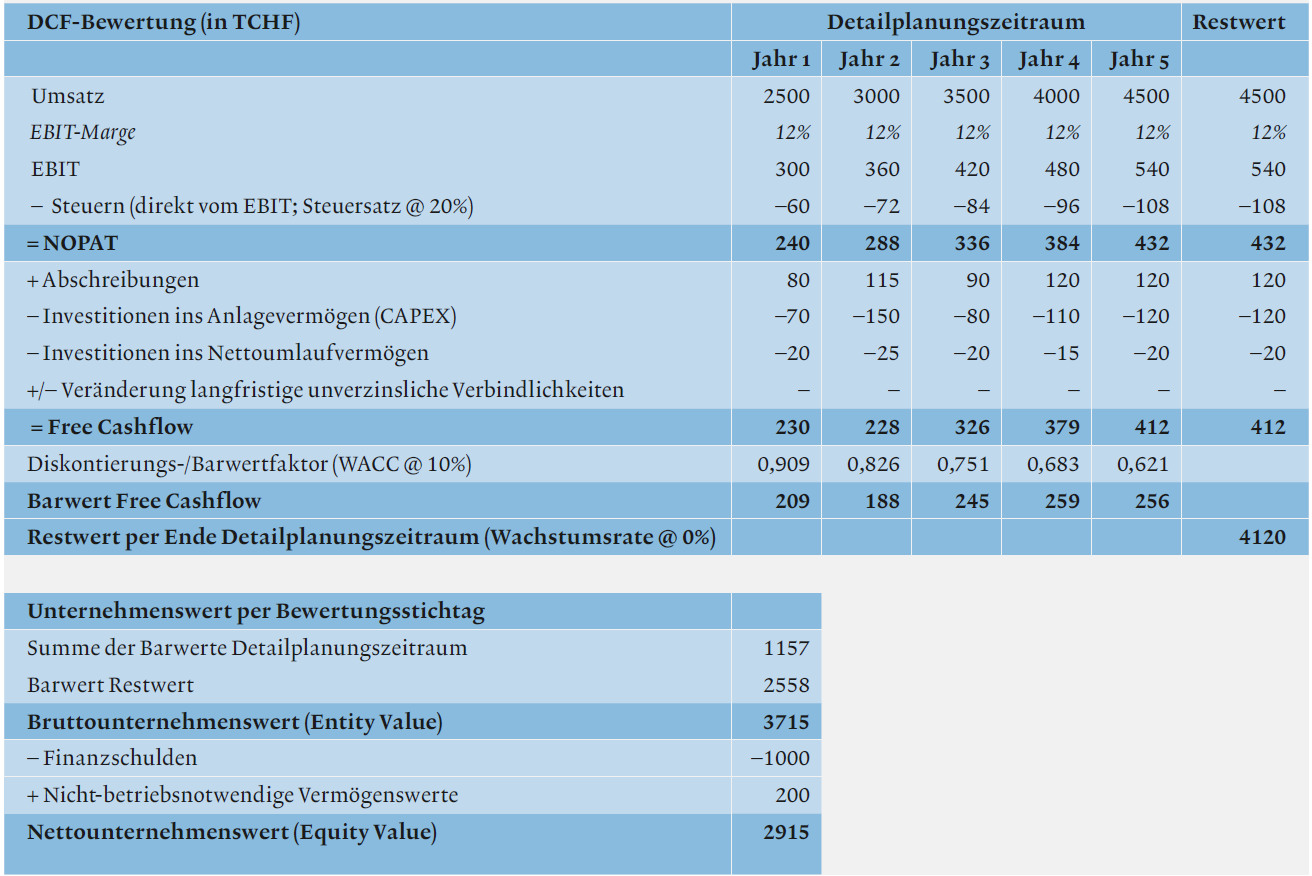

The textbook model of a DCF valuation provides for a dichotomy: The differentiated detailed planning is followed by a simply estimated residual value. The importance of this residual value for the enterprise value is high, and thus valuation theory has also been intensively concerned for some time with what can happen behind the horizon of a yearly planning. Two approaches can be identified: On the one hand, an attempt is made to reduce the influence of the residual value by taking a few roughly planned annual slices. Secondly, the conditions of perpetual growth – profitability and investments – are critically examined. These considerations have meanwhile also found their way into the professional recommendations on business valuations in Switzerland and Austria.

Already in the last update 2019, the authors pointed out that digitalisation will lead to longer planning periods and uncertain residual values. In light of the Corona crisis, this is even more true. The control handle “investments = depreciation?” may still be necessary for residual values, but it is certainly not sufficient. Therefore, in view of the current situation, a few tips from the perspective of valuation theory on the practical calculation and plausibility of residual values.

Read the complete article from EXPERT FOCUS 6-7|2020 here (in German).