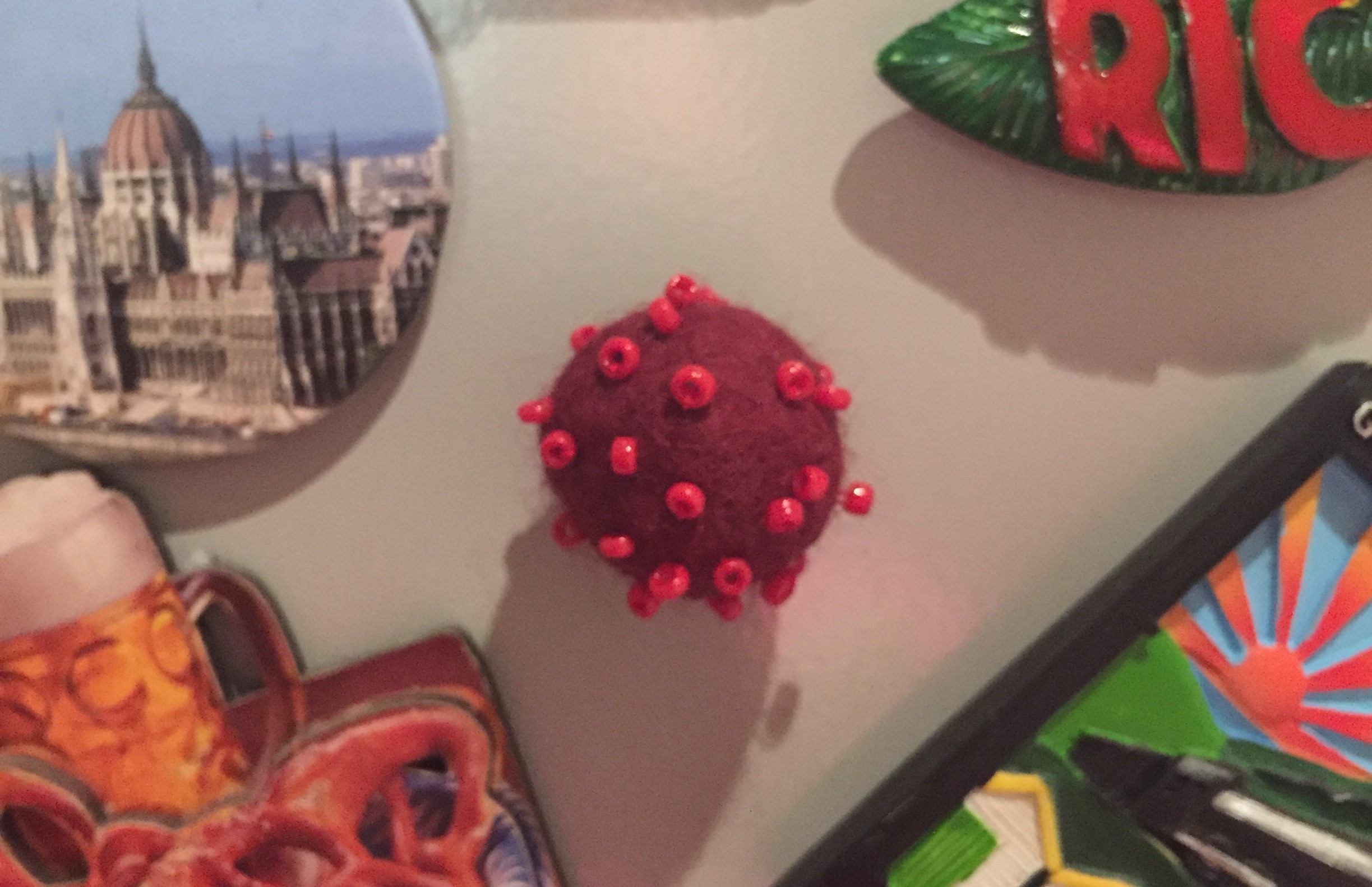

Company valuation in times of the virus

Notes on the valuation of companies in and after the Corona crisis

Crises and company valuations have one thing in common: the end is decisive! The following article provides advice on company valuations in and after the Corona crisis.

Valuation occasions and valuation methods

“Il est urgent d’attendre” – so Talleyrand, and one would gladly wait for calmer times with per se uncertain company valuations. But even in the current crisis, companies have to be valued, be it in the context of time-bound transactions (squeeze-out), pending proceedings (divorce, inheritance, severance payments) or for accounting and taxation purposes (impairment). There are also distress sales and opportunity purchases that make valuation considerations necessary. So there are also valuation occasions in and especially after the crisis.

The current gloomy outlook does not change the fact that only a future earnings value is an appropriate enterprise value. DCF methods will therefore – with certain adjustments – continue to be best practice.

Due to its past orientation, the practitioner method already belongs methodologically to the risk group and will probably fall victim to the virus: Theory has long criticised the fact that the past is not necessarily a suitable reference for the future. We are all currently experiencing that in practice, too, very little remains as it was.

Planning: Rake, EBITBC and EBITAC

The virus is a stress test for every business model and every plan. Plans made before Corona are probably no longer usable. But what happens next? Popular are shortening assumptions about the further course: “U”-valley, “V”-incision or “L”-crash. Most companies currently see a “rake”, i.e. a rapid downturn, and hope for a speedy recovery. Whether this can lead to pre-crisis levels depends – as with infected patients – on the constitution: margins, reserves, liquidity. In the time comparison we will clearly see the caesura, the EBITBC will be a different one than the EBITAC (EBIT before/after Corona).

The assumptions on which the planning is based must therefore be critically reviewed: Does the business model still fit, what turnover and profit or cash flow can be expected in the medium to longer term, can and should the planned investments be carried out, must the net working capital have a buffer, are the value adjustments sufficient and, above all, what about the liquidity required for operations? Quarantine and social distancing have clearly shown how strongly person-related the functioning of a company is.

The detailed planning period ends when the company has reached its “steady state”. At present, this will probably take more than the usually assumed three to five years in many cases. Detailed planning periods of up to ten years or more are recommended. Short-term aid programmes should not lead to a positive assessment if there is no sustainable earning power.

Read the full article from EXPERT FOCUS 6-7|2020 here (in German).