The new EXPERTsuisse “Specialist Communication on Business Valuation”

Background, innovations, highlights

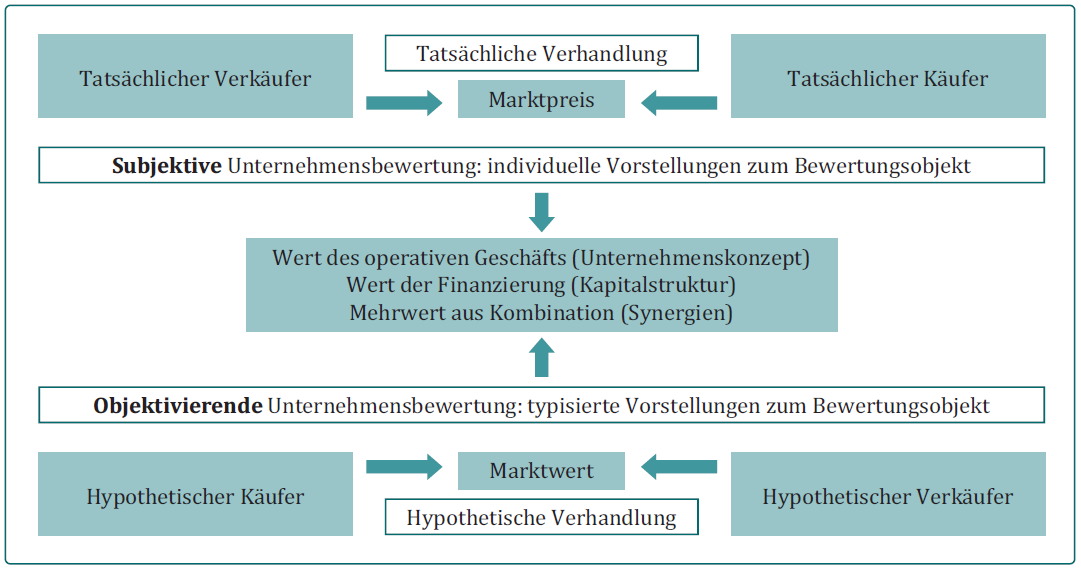

EXPERTsuisse’s technical memorandum on company valuation has been revised to include the valuation of larger companies, whereas the 2008 version focused on small and medium-sized enterprises. Prof. Tobias Hüttche and Dr. Fabian Schmid provide an overview of the change and its background and highlight the main contents. In addition to the handling of the mandate and the valuation principles, the methodology is also discussed: In principle, the discounted cash flow method is used, although a valuation using multiples is now mentioned as a separate method (due to the opening up of the scope).

Introduction

Unlike an audit, a company valuation is not a recurring and predictable mandate. Nevertheless, the necessary specialist knowledge must be up to date and the tools of the trade must be available.

EXPERTsuisse’s specialist work in this area has a long tradition. The first technical communication on the subject of company valuation dates back to 1994 and was revised in 2008. The focus there was still on the valuation process and reporting, not on value calculation in the narrower sense. The “Specialist communication on the valuation of small and medium-sized enterprises (SMEs)” adopted in 2018 was intended to provide guidance for SMEs in particular.

This still recent announcement was positively received by interested parties – i.e. companies, consultants, auditors, but also tax authorities and the courts. The question soon arose as to whether and to what extent the principles described there for the valuation of SMEs could also be applied in other cases. This is also because – unlike in Germany or Austria – there is no binding standard for the profession in Switzerland to which reference can be made when valuing larger or listed companies.

The authors of this article are members of an EXPERTsuisse working group that is responsible for the specialist work on the subject of company valuation. From this perspective, they provide an overview of the changes and their background and highlight key content and aspects.

Read the full article from the 2023 Finance and Accounting Yearbook here.