Financial planning for companies – how to achieve reliable planning

The future is uncertain. This makes planning it all the more important. Financial planning is a look into the future based on the past. It should help to see the effects of changes such as growth plans, price increases, margin pressure or a planned investment program on profit and liquidity.

Introduction

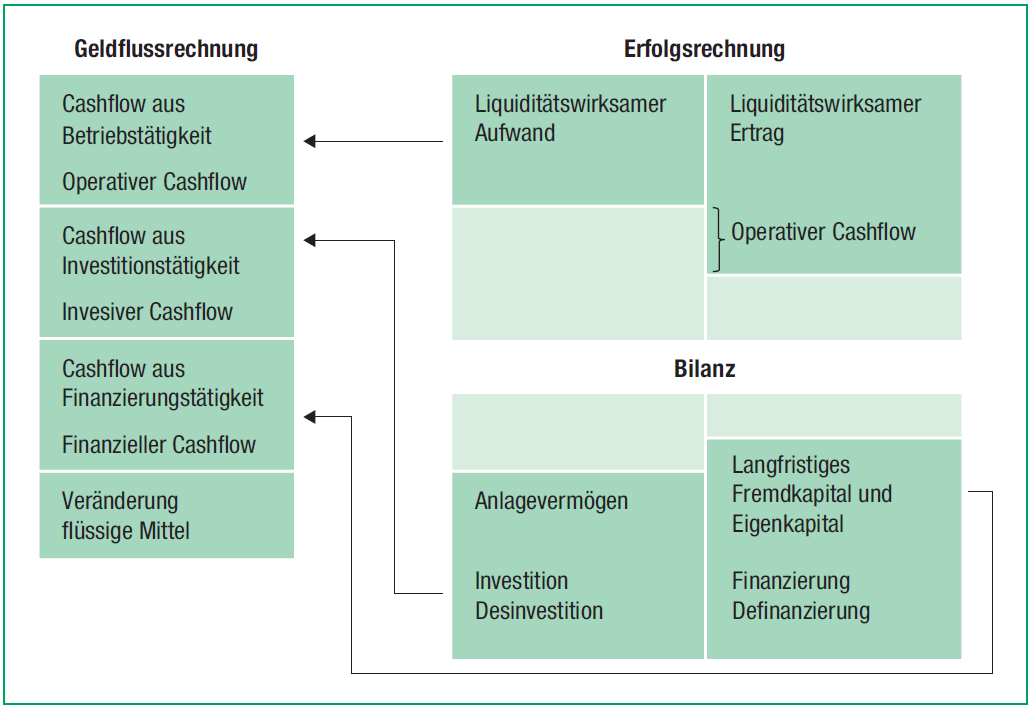

In contrast to the balance sheet and income statement, financial planning does not show the assets, financing and success of a company, but rather depicts the cash flow. Such a cash flow-oriented view is not only required by investors and banks, but also forms the basis for a company valuation. Furthermore, according to the law (Art. 716a CO), financial planning is one of the central tasks of a board of directors. The three instruments of financial planning are interlinked. The following explains how a reliable, future-oriented financial plan can be drawn up based on the current and past annual financial statements.

Read the full article from the Finance and Accounting Newsletter 03 | March 2023 here.