Digitalisation in business valuation

Will the business valuator still be needed in 10 years’ time?

Digitisation is on everyone’s lips. It affects practically all industries and fields of activity, not least also business valuation. Digitalisation creates new valuation objects, changes the business models of existing companies, influences the previous process of preparing, carrying out and presenting a valuation and has an impact on the required know-how of a valuer.

The aim of this article is to show the expected effects of digitalisation on business valuations and to give an outlook on the direction in which the journey could go. It is undisputed that business valuations will continue to be needed in the future, possibly even in greater numbers and with increasing frequency. What remains to be seen is how digitalisation will affect valuation theory and the valuation process, or whether the business valuator will still exist in ten years’ time or whether he will already have been completely replaced by a “machine”.

Effects of digitalisation

Digitisation is not a new phenomenon. It is associated with the processing of information in analogue form into a digital system. The effects associated with this digital transformation are exponential growth, the fact that it is not tied to a specific location, the almost unlimited possibilities for use, the scaling of digital technologies and the sustainable change process. What is new, however, is the speed and the disruptive forces that affect business models that have been successful for years.

Digitalisation has several links to business valuation:

- new and changing valuation objects (especially from the platform economy)

- the valuation process (especially cash flow forecasting and risk analysis)

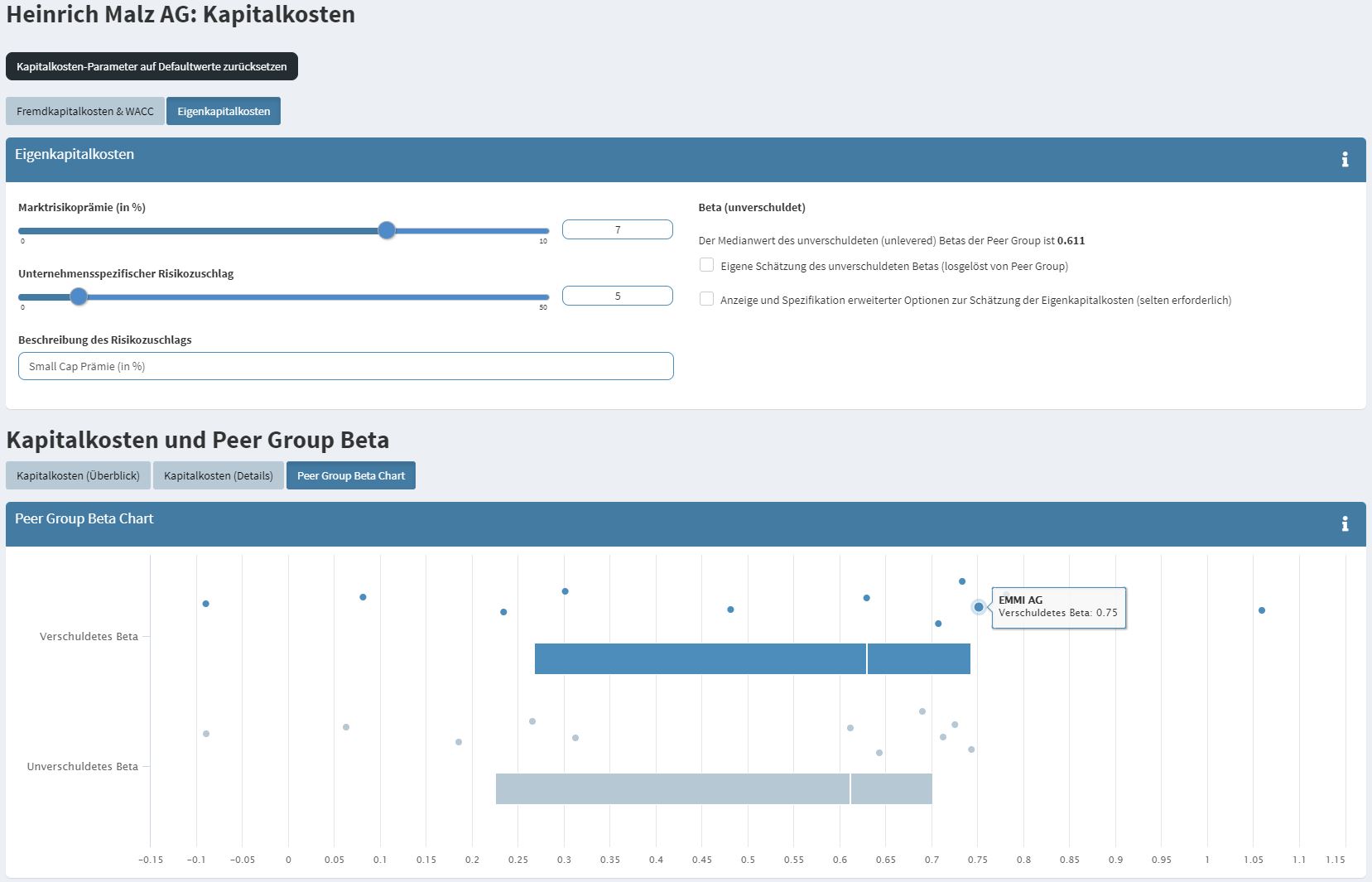

- the extraction of important valuation parameters (especially the cost of capital).

Read the full article from the Jahrbuch Treuhand und Revision 2020 (in German) here.