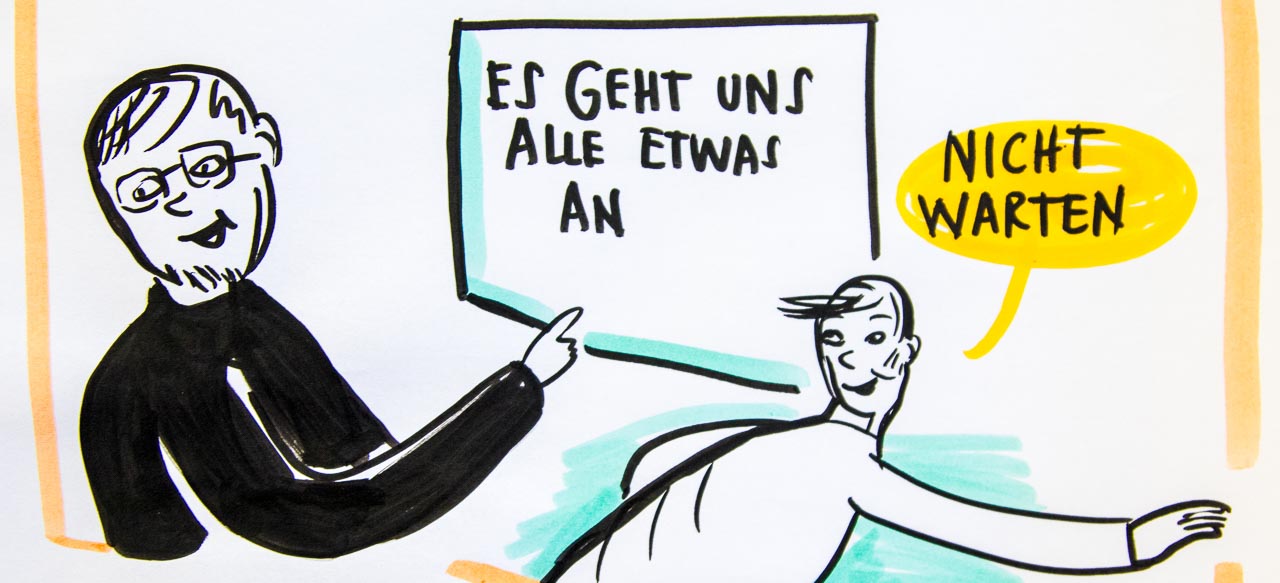

Do we have to wait urgently?

Talleyrand, Corona and business valuation

In response to our article “Company Valuation in Times of the Virus“, we were asked whether it is not too early to make recommendations, or whether – according to Talleyrand – it is not more urgent to wait. We don’t think so; on the contrary, it is precisely now that values are at stake. The crisis brings devaluation risks but also buying opportunities (reference to Deloitte). However, priorities must be set correctly.

Planning must be reconsidered

First, more time must be spent on planning: Pre-crisis scenarios will no longer be useful. The business model (what is sold) and geography (where is it sold), the company’s own reserves and the prospect of outside help (reference to Damodaran) are decisive for further development. Detailed plans must be made until a steady state can be assumed again – also in macroeconomic terms.

Adjustment of the cost of capital?

So what is the cost of capital? Even without a crisis, this is already a controversial question. At least that the cost of equity cannot be lower than before the crisis will be a matter of consensus. Incidentally, the recommended ranges give sufficient leeway and discretion (reference to our contribution).

Durability of ratings

Of course, all currently produced valuations have an even shorter expiry date than before. Statistics is the correct addition of wrong numbers – again Talleyrand. We don’t want to claim that for business valuation, but what is certain is that we will probably have to review our assumptions quickly and thoroughly.