Determining the cost of capital in practice

How to systematically derive the cost of capital for SMEs.

This article presents how to estimate the cost of capital, and in particular the cost of equity capital, including for SMEs, in a systematic and market-based way. The suggested methods are based on theoretical considerations, geared to current practice and in line with the professional communication “Valuation of small and medium-sized enterprises (SMEs)” by Expertsuisse.

Introduction

The cost of capital is a crucial element in every business valuation, especially of SMEs. Knowing this cost is essential for discounting the available cash flow at the valuation reference date. In principle, the cost of capital can be estimated subjectively or be derived, as a model, from market data.

Business valuations are generally performed on an entity basis, particularly when the discounted cash flow method (DCF) is applied. This method provides for the free cash flow to be returned to the lenders of foreign capital and equity, before any financing charges. The cost of capital must therefore compensate for the risk incurred by the lenders and borrowers: it must therefore be a blended rate, the Weighted Average Cost of Capital (WACC).

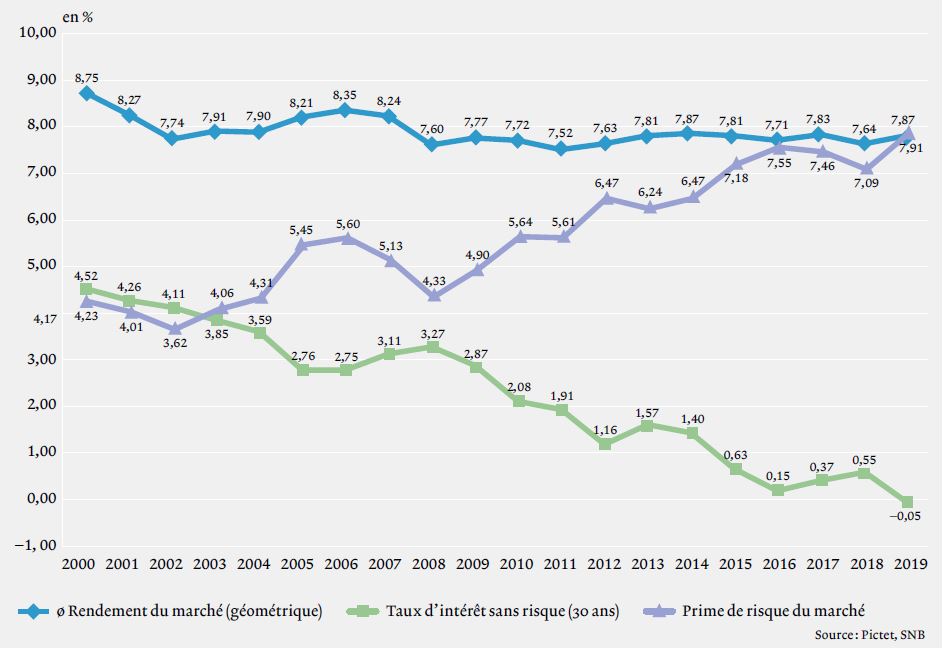

For non-experts, the determination of the cost of capital often remains a mystery. Some doubt that capital market theory can provide useful knowledge for a non capital market oriented company (such as an SME). This is the starting point of our article, in which we will explain the determination of the cost of equity, foreign capital and WACC and present appropriate sources for SME valuations, as well as current capital market data.

Read the full article in EXPERT FOCUS 12|2020 here (in French).