May it be a little more?

Theory and practice of premiums and discounts in the valuation of SMEs.

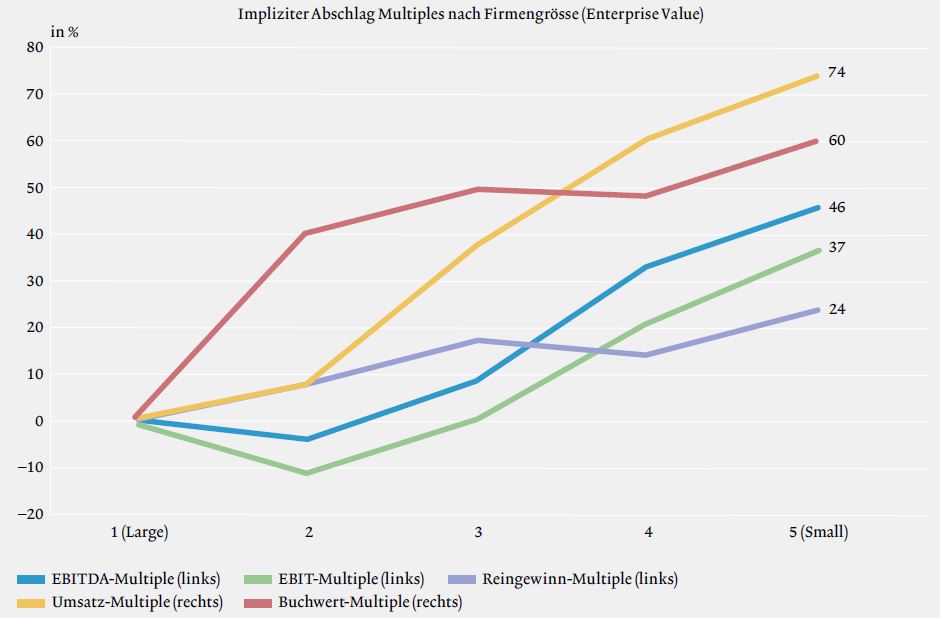

In business valuations, practice mainly discusses the numerator, theory the denominator. Theoretically, risks are to be considered primarily in the financial surpluses. In practice, surcharges “below the line”, i.e. on the interest rate, dominate. This is especially true in the valuation of SMEs.

Introduction

SMEs are special valuation objects: Their success depends on the owners, the shares cannot be sold easily, and the insolvency risk is comparatively high. These differences compared to the standard object of valuation theory, i.e. an investment that can be sold at any time in a company that is independent of the owners and has an unlimited life, must be taken into account in the valuation.

This can be done mathematically when planning the financial surpluses – i.e. “above the line” – or when discounting them – i.e. “below the line”. Preferable, because it is transparent and conforms to the model, is the modelling of the special features in the numerator. Simpler – but less well-founded and therefore controversial – is a corresponding surcharge on the discount rate or an overall discount on the enterprise or share value.

Valuation practice usually takes the simpler route with a pragmatic but circular reference to practical practice. This is inconspicuous when it comes to calculating subjective enterprise values in the context of the advisory function. If, on the other hand, an objectified valuation is required, every assumption and every step of the valuation must be comprehensible and ultimately defensible. A reference to practice only helps here if it is also theoretically supported and empirically verifiable or does not seem outlandish. In company valuations, and especially in the current market situation, it is not always possible to have both, i.e. a coherent theoretical model and its empirical confirmation.

We are aware that valuation theory is critical of mark-ups and mark-downs. In this paper, the authors will not be able to provide the theory that has been lacking up to now. However, models without empirical support offer little in the way of explanation or knowledge. In other words, empirical research should be an occasion to question theoretical models and, if necessary, to develop them further. Our aim with this contribution is to provide Swiss valuation practice with empirically supported recommendations and to be prepared for theoretical objections. This provides a further incentive to return to the theory of this phenomenon.

Read the full article from EXPERT FOCUS 12|2020 here (in German).