BLOG. DAMIT SIE INFORMIERT BLEIBEN.

Business Valuation Update 2021

The latest developments in business valuation theory, practice and jurisprudence In business valuations, theory and practice, economics and jurisprudence meet. This ensures dynamism in valuation theory, practice and jurisprudence. The “Business Valuation Update” reports annually […]

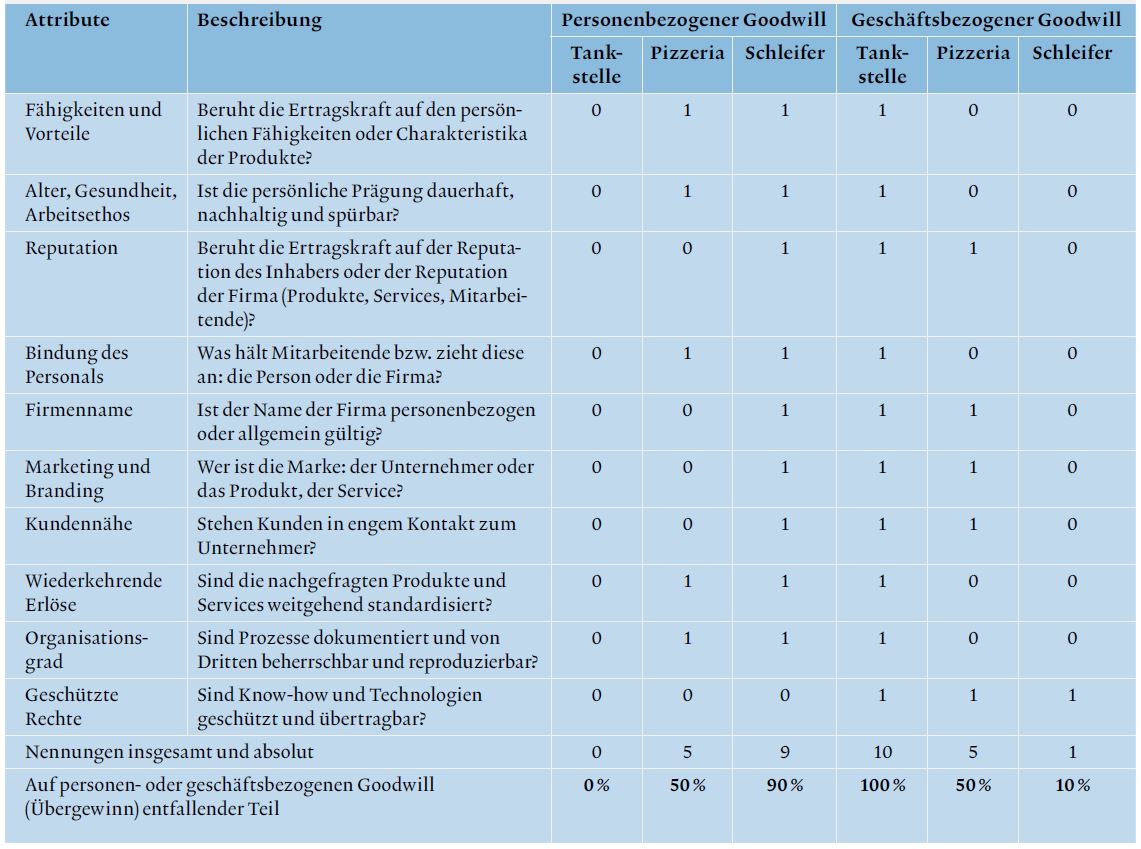

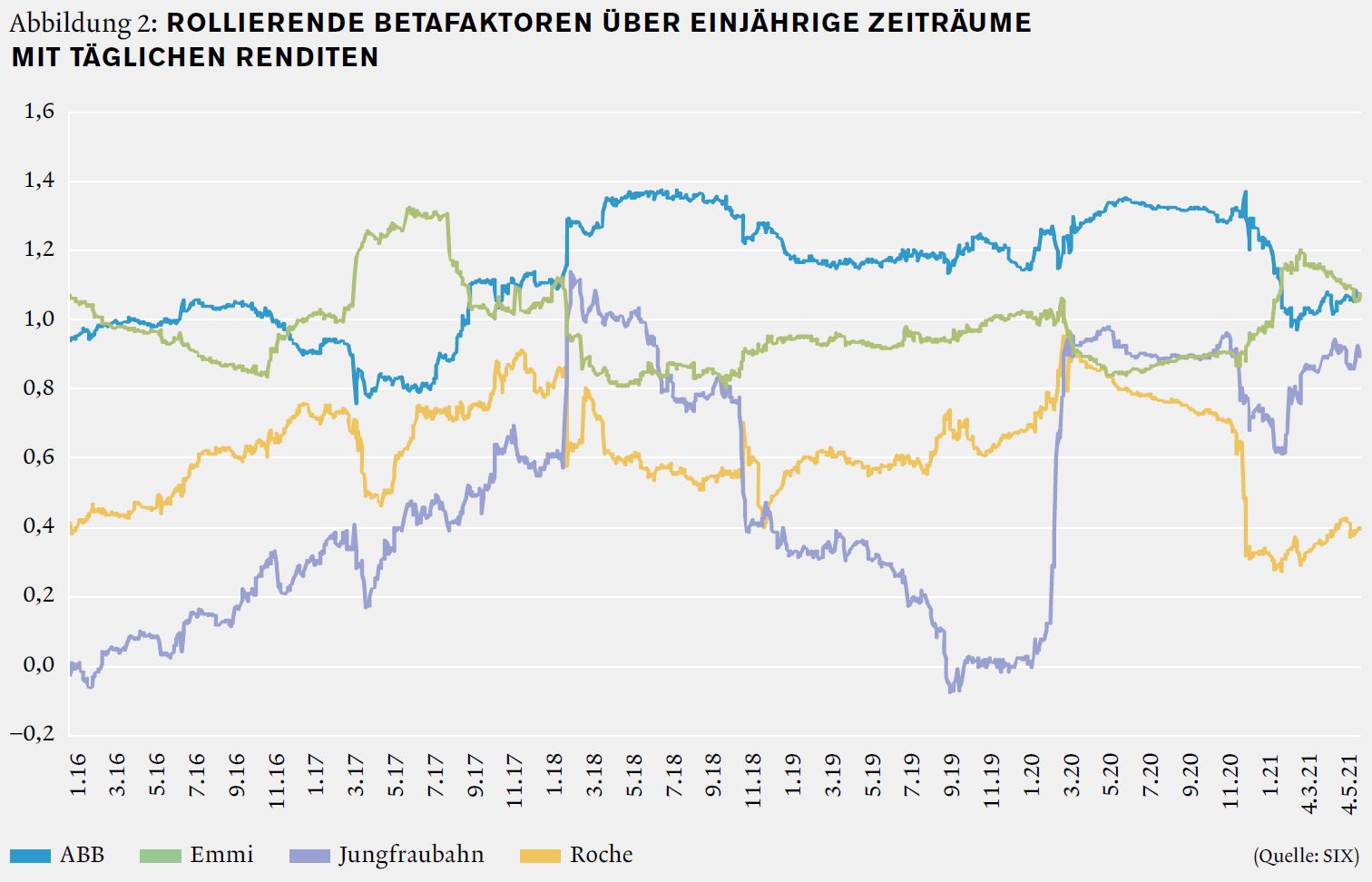

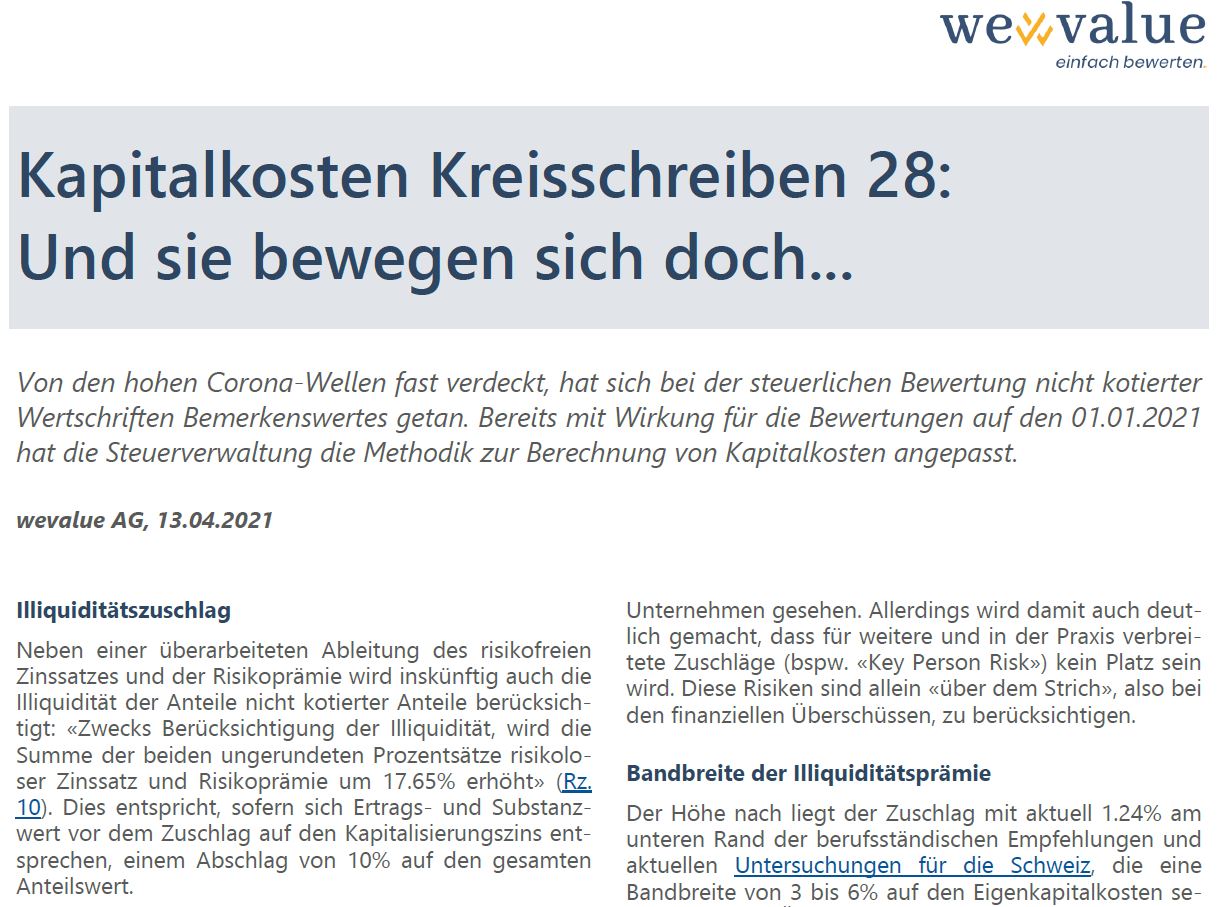

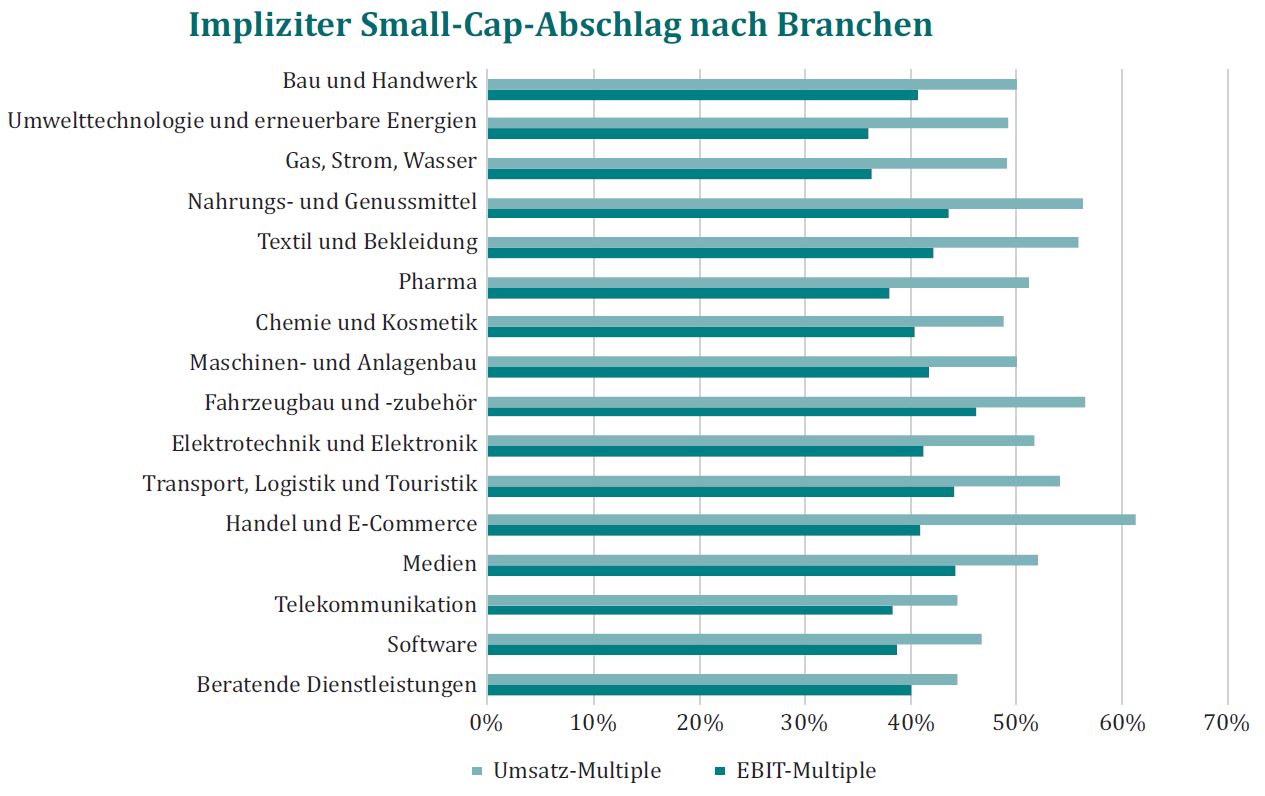

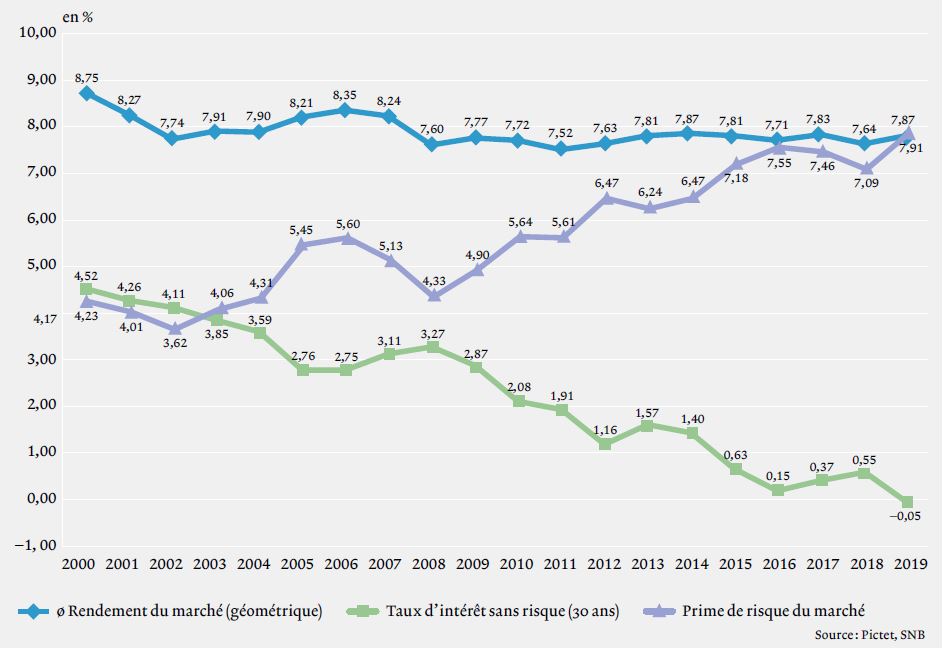

Premiums and discounts in the business valuation of SMEs – theory, practice and empirics

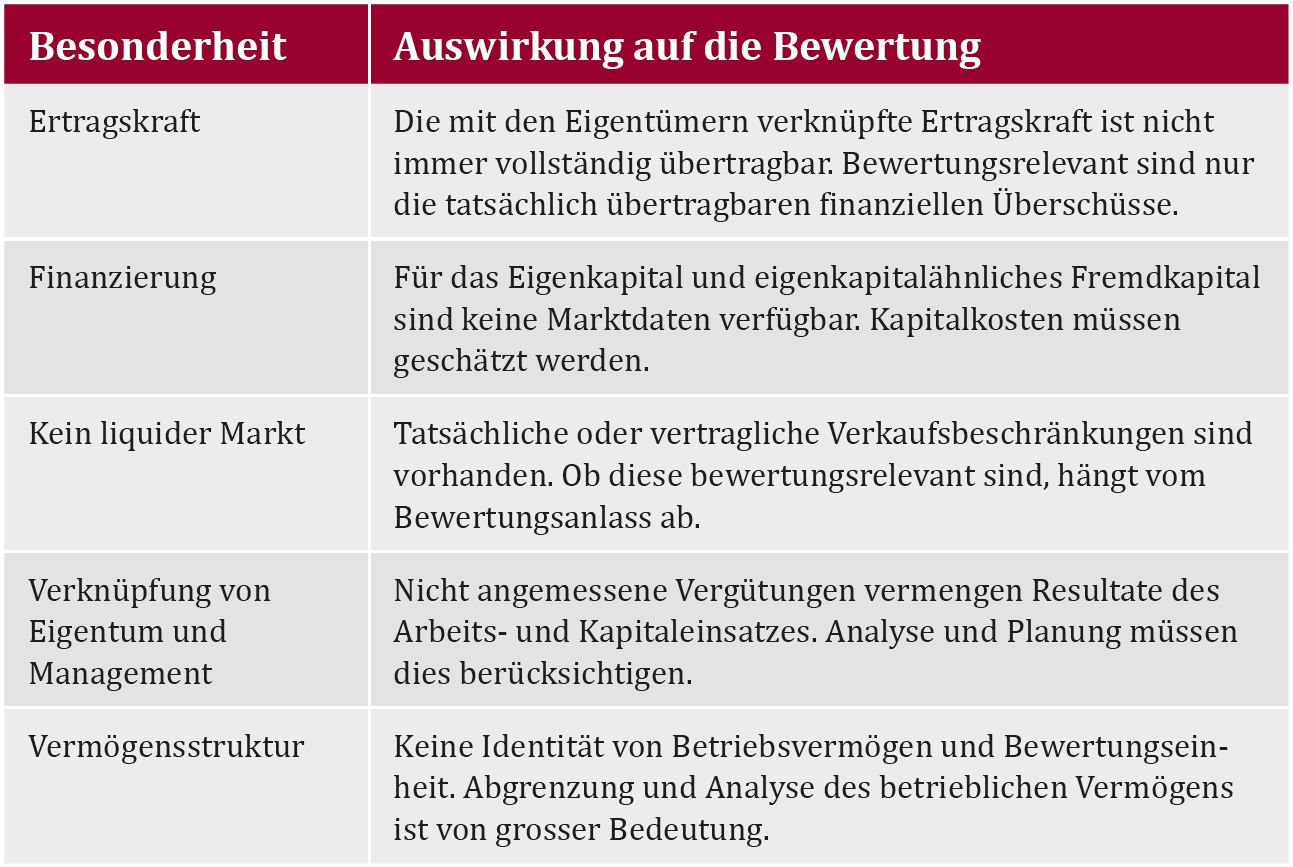

Introduction There are no special methods for the valuation of small and medium-sized enterprises (SMEs); however, their special features must be taken into account in business valuations. Special features in this sense are all deviations […]