Valuation of SMEs with multiples

Or: Of apples and pears

With multiples, a company valuation seems possible in no time at all: EBIT multiplied by a factor results in the company value. But simplicity is also a pitfall: apples are quickly valued like pears. This article deals with company valuation with multiples and shows how SMEs can also be properly valued with this method.

Introduction

Recent research shows the popularity of multiples among Swiss companies: After the DCF method, which is considered best practice, it is the second most popular valuation method. Expertsuisse’s 2018 revised technical note “Business Valuation of Small and Medium-sized Enterprises (SMEs)” also provides for a market-oriented valuation with multiples as one of the possible valuation methods.

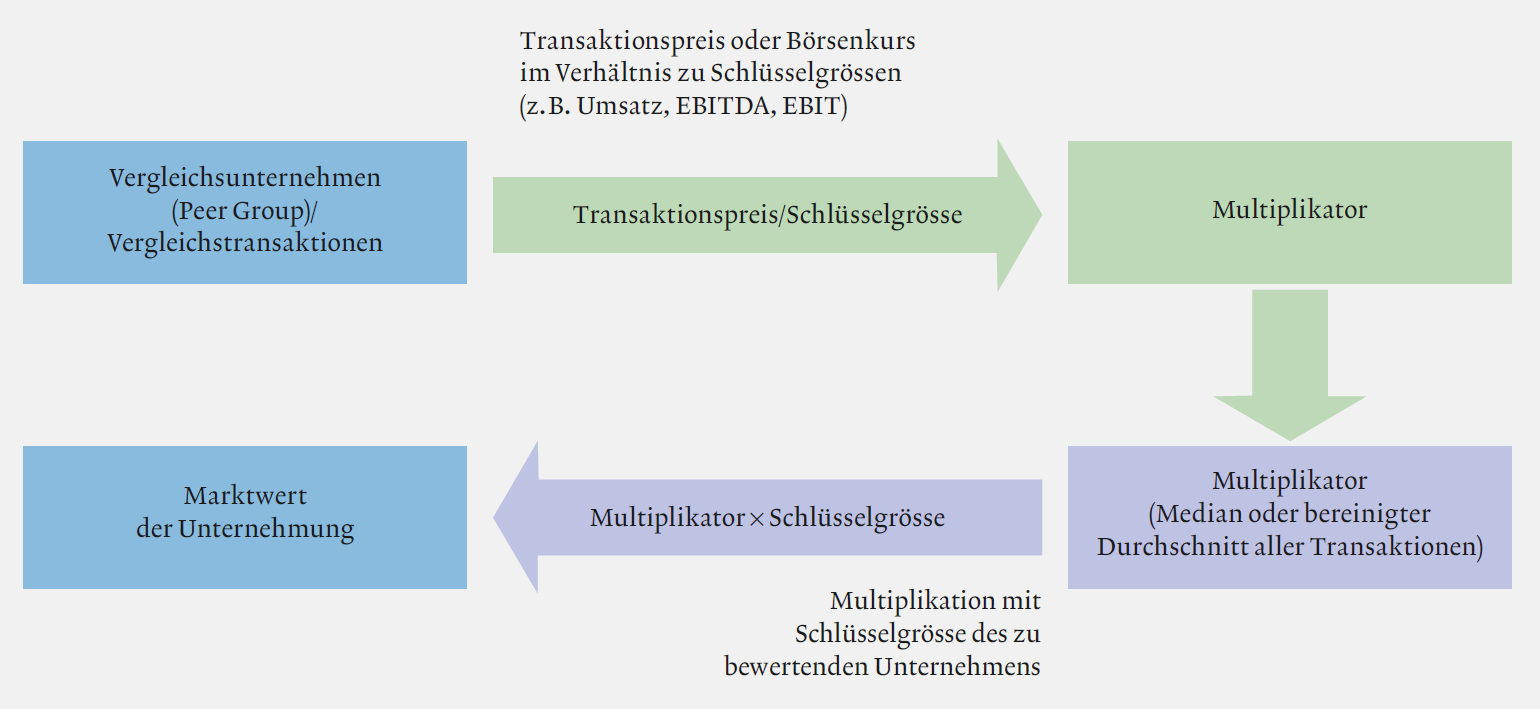

The use of multiples is based on the Law of One Price: identical prices are paid for identical goods, so that the price of one can be used to infer the price of the other. However, companies are never identical, but at best comparable. In a company valuation with multiples, the market value of comparable companies (i.e. their price) is therefore transferred to the company to be valued via a key figure (e.g. EBIT, EBITDA or turnover). This then results in the company or share value. Figure 1 shows the individual steps graphically.

Valuation with multiples appears simple, fast, objective – and thus superior to a DCF valuation. In fact, a proper multiples valuation requires answering different, but nevertheless complex questions: 1. what does the comparability of a company mean? 2) How does one obtain market data? 3. which key figure is meaningful, which is not? 4) How can one justify and explain differences in value to the DCF method, but also between individual multiples?

The following article takes up and answers these questions. After a brief introduction and clarification of terms, the authors present the results of their own analyses for the Swiss market. Valuation differences are analysed and explained. Finally, they show how an SME can also be properly valued using multiples derived from data of listed companies.

Read the full article from EXPERT FOCUS 2019|12 (in German) here.