SME succession and the valuation

The methods are given – the decisive factors are the adjustment, analysis, forecast and interpretation of the numerical material

“How much does a business cost me?” This is one of the most important questions of the successor generation. “What do I get for the business?” This is one of the most important questions of the seller. The only certainty regarding these questions is that value does not equal price! “What is my business worth?” is, first of all, the standard question of any business owner who is considering internal succession options or selling his or her business. On the other hand, the potential successor asks himself, “Can I finance the company? What is the actual value of the business?”.

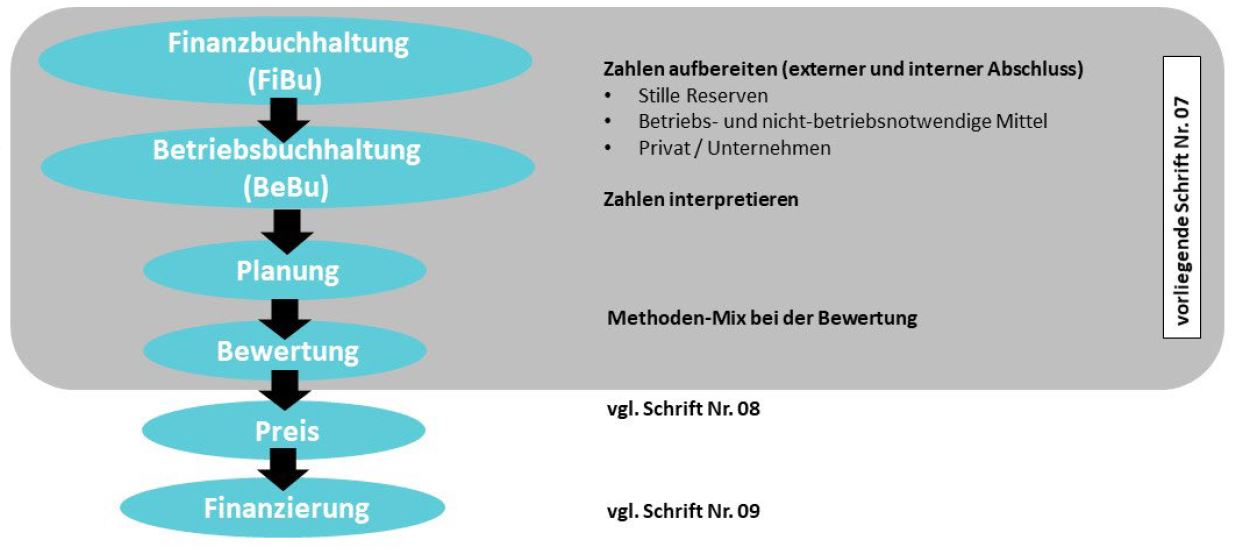

In the 5-themed wheel of the St. Gallen Succession Model, the central statement is made that value is not equal to price. Simplified, you can say “value is what you get – price is what you pay.” Essentially, there are three dimensions and their associated issues to resolve in order to establish a number in the function of a price at the end of a succession process in terms of contract law and thus binding between seller and buyer. Since there are different steps to be taken into account in each of these three dimensions, a separate paper is devoted to each dimension.

The present document provides the essential basics in the sense of a 1 x 1 around the partial aspect “valuation”. Not only the methods as such are important! The preparation and interpretation of the used and received numerical material must be carried out carefully, otherwise the evaluation as such gets the flavor of “smoke and mirrors”.

Read the complete article (in German) here, which was produced in cooperation with the St. Galler Nachfolge-Praxis.