Financial planning for companies – how to arrive at a resilient plan

The future is uncertain. This makes its planning all the more important. Financial planning is a look into the future based on the past. This should help to see the effects of changes such as growth plans, price increases, margin pressure or a planned investment program on profit and liquidity.

Introduction

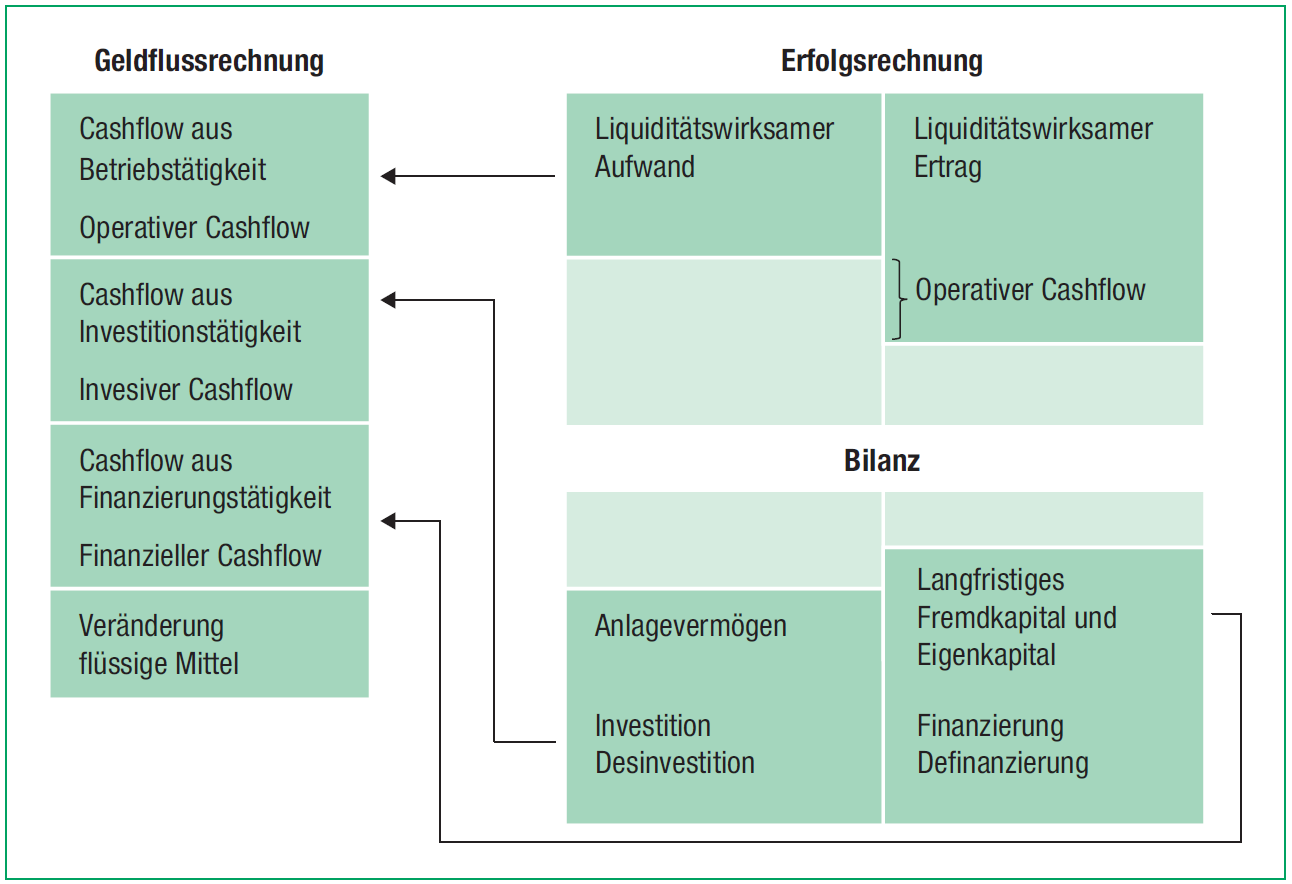

In contrast to the balance sheet and income statement, financial planning does not show the assets, financing and success of a company, but maps the cash flow. Such a cash flow-oriented view is not only required by investors and banks, but also forms the basis for a company valuation. Furthermore, financial planning is one of the central tasks of a board of directors according to the law (Art. 716a OR). The three instruments of financial planning are interlinked, as shown in Figure 1. In the following, it is explained how a reliable, future-oriented financial plan can be prepared on the basis of the current and past annual financial statements.

Procedure

- Prepare balance sheet and income statement for previous years and analyze developments and value drivers.

- Prepare cash flow statement and link it completely to balance sheet and income statement.

- Plan sales as a driver for numerous income statement and balance sheet items.

- Plan income statement down to EBITDA level.

- Plan balance sheet, especially operating current assets (accounts receivable, inventories, accounts payable), fixed assets (investments), and liabilities (financing).

- Complete the income statement down to the profit level, i.e. specifically plan depreciation, interest and taxes.

- Plan any distributions.

- Complete the balance sheet and – if not already done – derive the cash and cash equivalents from the balance of the cash flow statement.

If financial planning is fully linked and integrated, then the following should apply:

- Assets and liabilities in the balance sheet are balanced.

- The profit in the income statement corresponds to the profit in the balance sheet (as part of equity or reserves).

- The change in liquidity in the balance sheet compared to the previous year corresponds to the balance in the cash flow statement.

Read an excerpt of the article from the March 2023 Finance and Accounting newsletter here (in German). You can purchase the full article at the following link.