Consideration of uncertainties in the company valuation

Introduction

Company valuation is actually impossible, as it concerns the future and this is uncertain. Nevertheless, company values are necessary for many reasons, which raises the question of how these uncertainties can be taken into account in valuations.

Traditionally, this has been done by using the past as a basis for planning, i.e. more or less simply extrapolating it. In view of current experiences (coronavirus pandemic, Ukraine war, inflation and energy crisis, to name but a few), the hope remains that these will not become permanent. On the other hand, however, new and as yet unknown developments or developments that are considered unlikely or not at all are also to be expected.

In order to be able to produce reliable valuations as a basis for economic decisions even in times of increased uncertainty, the selection of suitable procedures and the appropriate handling of risks are of particular importance.

In principle, uncertainties or risks can be taken into account above the line – in the numerator or in the cash flows – or below the line – in the denominator or in the cost of capital. It is crucial that there is no double counting and that the denominator matches the numerator (equivalence principle), i.e. that the cost of capital adequately reflects the fluctuations in cash flows.

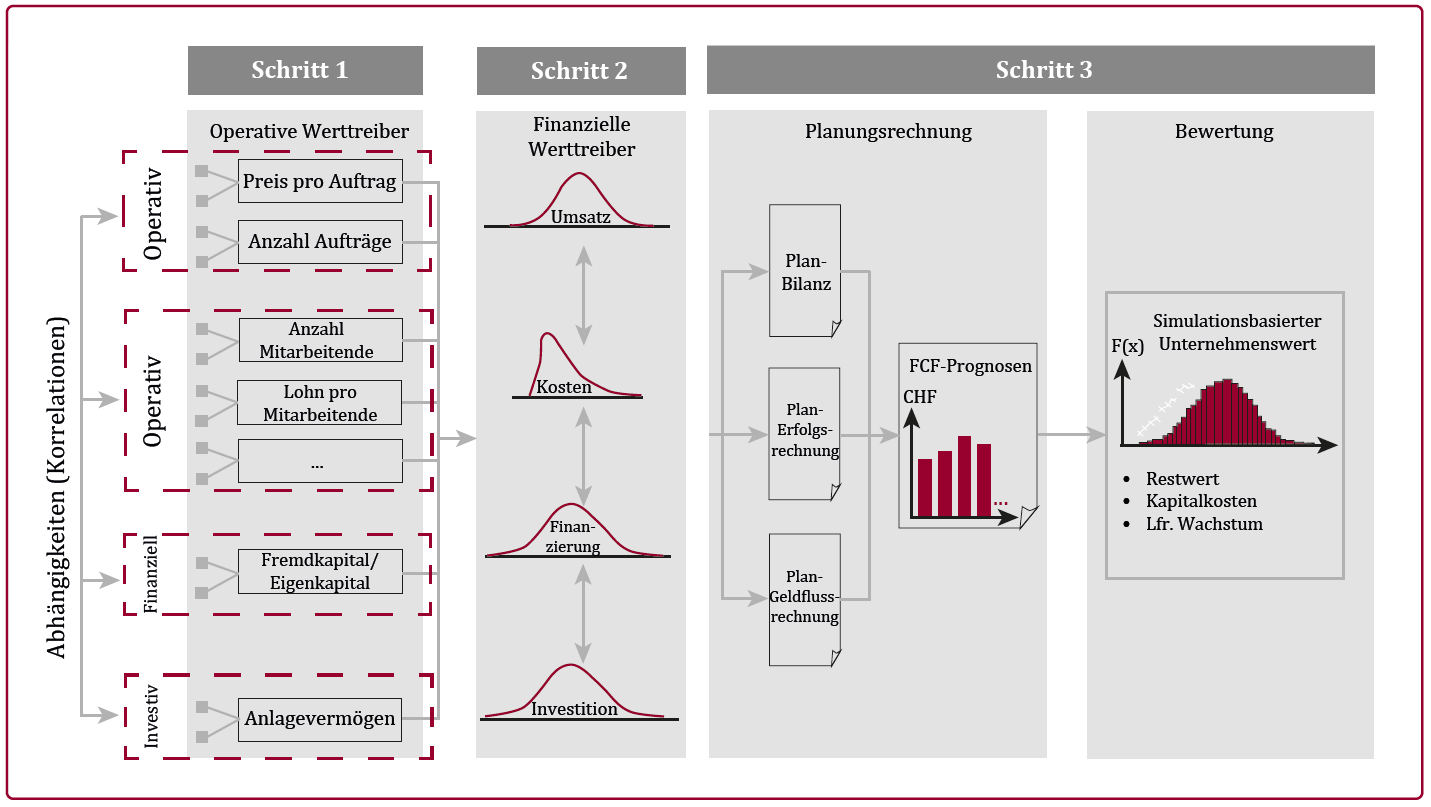

To date, valuation practice has largely been based on single-value planning. This article is intended to show how the classic valuation approach can be expanded through sensitivity analyses, scenario calculations and simulations in order to move from pure point estimates to reliable value ranges that may reflect reality more accurately.

Sections 2 and 3 present the basics of valuation theory and the cost of capital, before going on to discuss the three approaches for taking uncertainties into account when valuing a company.

Read the full article from the Fiduciary and Auditing Yearbook 2023 here.