Valuation of young companies (start-ups)

Not every start-up becomes a “unicorn”, many remain an SME. This is why the valuation of young companies is also an issue in the fiduciary sector. The value of these initially insubstantial companies is literally a matter of opinion. In this article, we first present the possible and usual procedures from the perspective of investors and owners. Finally, we discuss the special features of an objectifying valuation and come across new and old acquaintances, namely “data” and the intrinsic value.

Introduction

Young companies or start-ups are valued for the same reasons as established companies, for example when investors come on board, when owners leave or when employees join the company. And unfortunately, founders of start-ups are also confronted with reality: Company value plays a major role in the event of death, divorce and shareholder disputes.

Unlike established companies, young companies have no past, little substance and a completely uncertain future. However, the reason for the valuation and the purpose of the valuation also determine the valuation concept and ultimately the valuation method. So when talking (or writing) about the valuation of young companies, a specific valuation task must be the starting point.

We therefore assume three different situations in our explanations and adopt different perspectives, in each of which the advice (or a valuation) of the trustee is required.

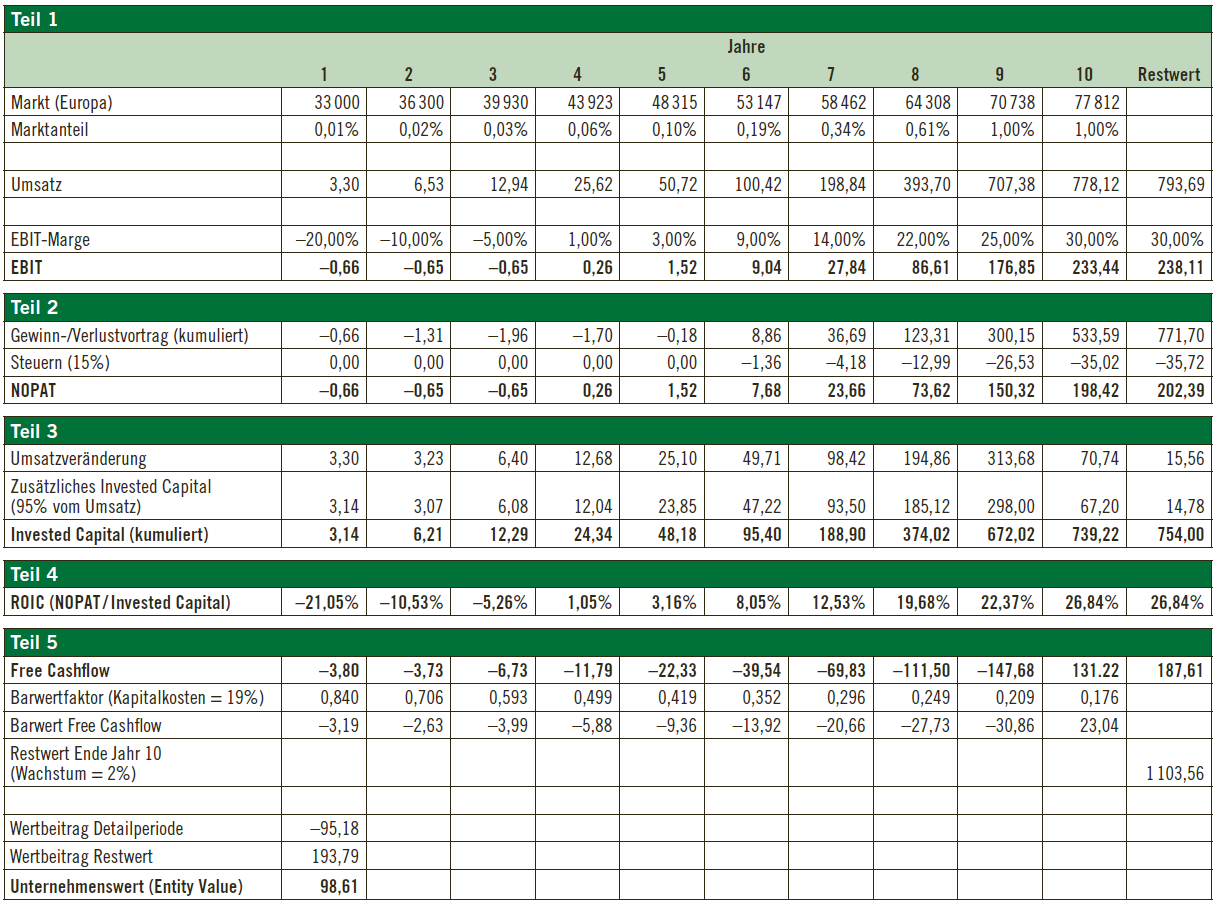

First, we look at the situation of the founders, who need a reliable company value to negotiate the entry of investors. We then switch roles and look at how the same company is valued through the eyes of the investors. Both perspectives lead to subjective company values, i.e. values that take into account the individual preferences of the valuation subjects.

These naturally biased values are unsuitable when it comes to conflict resolution. An objective assessment is required here. We also make a proposal for this – using the example of a compensation clause in a shareholders’ agreement.

Our aim is not to present and assess the entire universe of valuation methods for young companies. Our aim is to present three possible methods in a practical way.

Read the full article from TREX Der Treuhandexperte 3/2024 (in German) here.