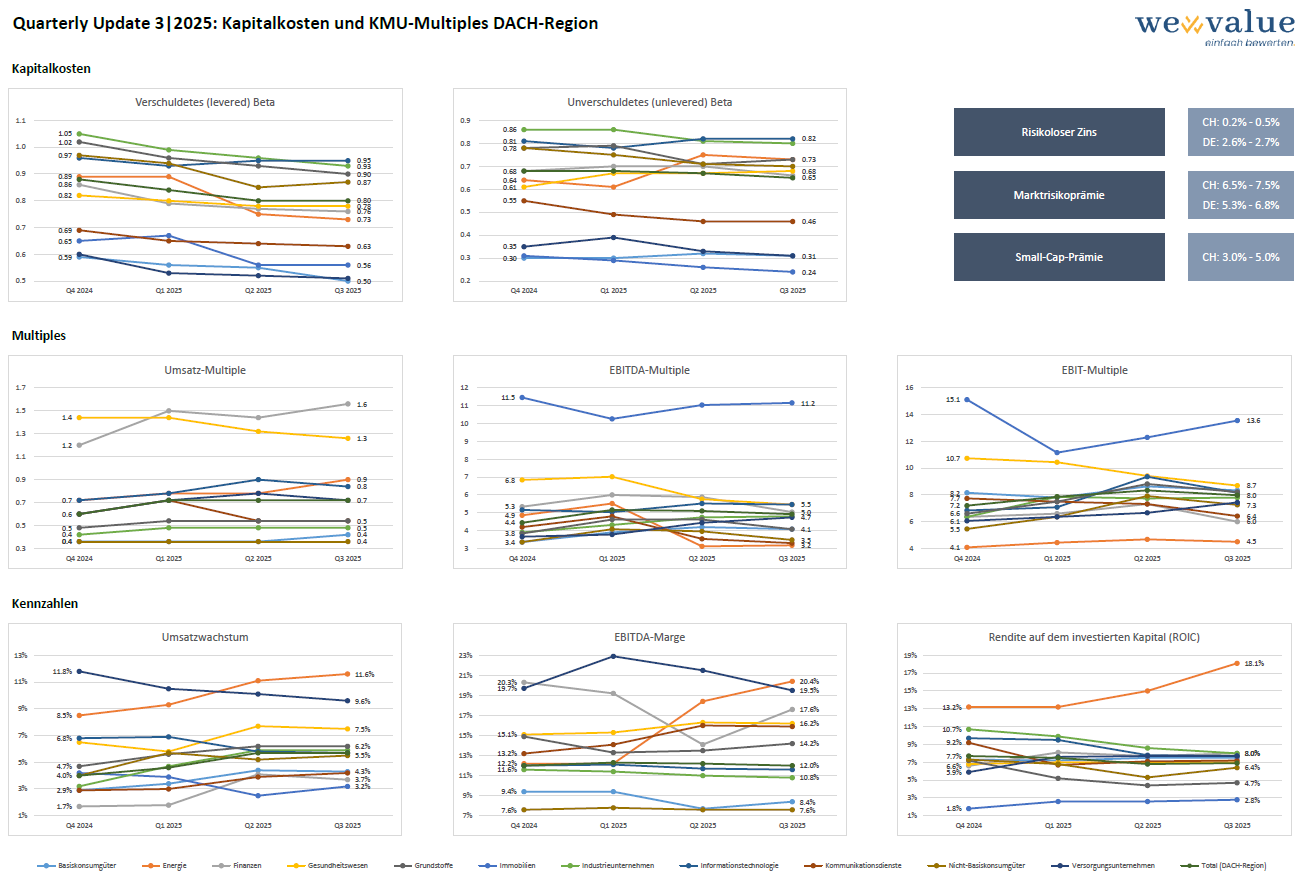

Quarterly Update 3|2025: Cost of capital and SME multiples in the DACH region

Are you evaluating an SME and looking for beta factors and multiples? Or would you like to compare your financial projections with selected industry benchmarks? We publish quarterly updates on capital cost parameters, SME multiples, and key performance indicators for numerous industries. You can find additional sub-industries and key parameters for over 7,000 comparable companies in our web-based valuation solution https://app.wevalue.ch.

Compared to the last quarter, levered and unlevered beta factors, all multiples, revenue growth rates, and EBITDA margins have declined slightly. On the other hand, returns on invested capital (ROIC) have risen slightly. While the risk-free interest rate in Switzerland has fallen slightly again, it has increased somewhat in Germany. As a result, the market risk premium in Germany has also fallen. The IDW has reduced its recommendation for this from the previous 6% to 8% to a range of 5.25% to 6.75%.