New features of our web-based valuation app (version 1.6)

Program version 1.6, which has now been rolled out, includes the following:

- Auto-save: You can now freely choose whether the entries should be saved automatically or manually.

- Residual value: A new overview monitor provides deeper insights into the parameterization of the residual value, making it easier to classify and understand.

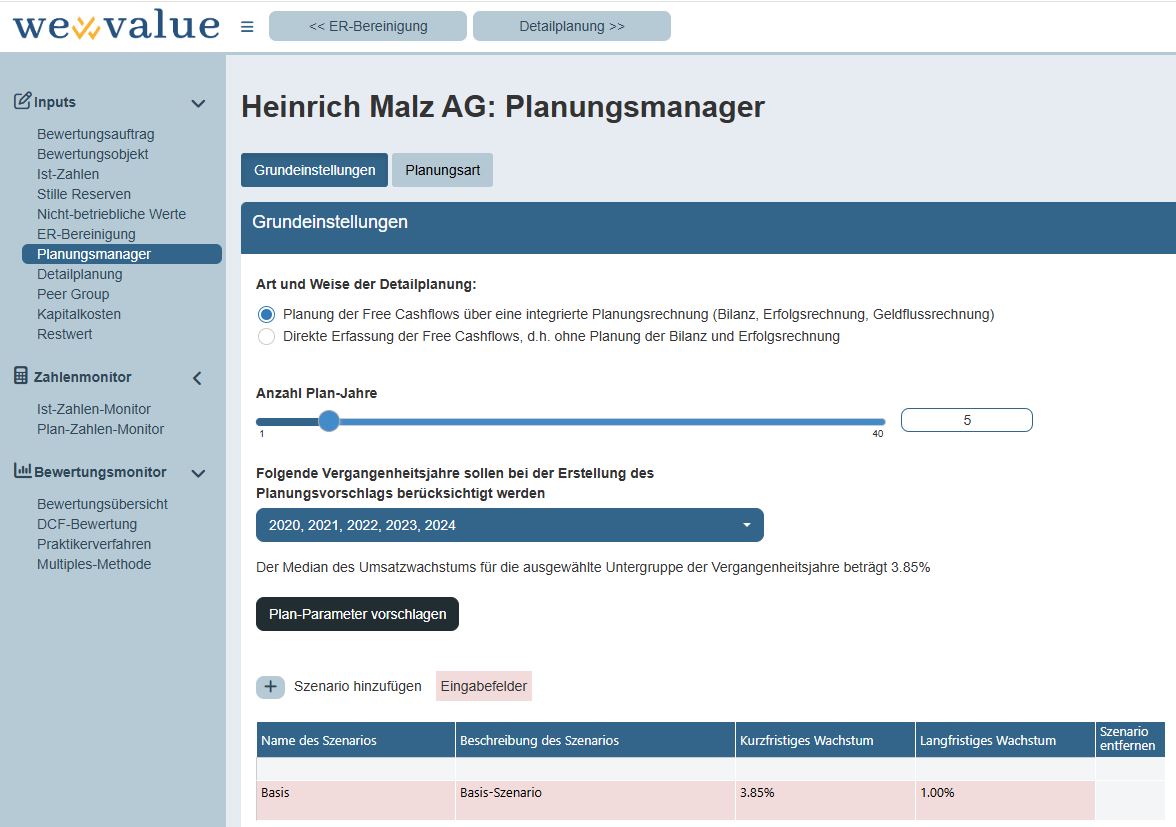

- Planning manager & detailed planning: The planning manager and detailed planning have been completely revised. Users can now define different growth rates for short and long-term planning for each scenario. In addition, outlier years can be excluded from the automated plan generation in order to achieve more realistic results. The planning type of the individual items is now defined centrally in the planning manager and no longer in detailed planning.

- Capital structure: Selection between actual and target capital structure for the cost of capital (including automatic calculation of the cost of equity and WACC based on the selected capital structure).

- Cost of capital: Interfaces and integrated sources for the risk-free interest rate and market risk premium so that these can be adjusted directly to the conditions on the valuation date at the touch of a button.

- Plan figures monitor: Expansion of the graphics for the key items in the plan figures monitor.

- Non-operating assets: Revision of the table for recording non-operating assets. In addition to the book value of non-operating assets, it is now also possible to record the market value as at the valuation date.

- Reports: Flexibilization of the reports so that only those valuation methods are consistently output that are also selected in the valuation overview.

- Disclaimer: A specific disclaimer can now be added for each valuation or stored centrally in the master data.

Get your own impression of the new version at https://app.wevalue.ch.

<< back

forward >>