Ensuring financial stability in companies through effective planning

The future is characterized by uncertainty, which makes careful forward planning all the more crucial. Financial planning is based on historical data and provides a glimpse into future developments. The purpose is to analyze the potential impact of changes such as growth strategies, price increases, margin changes or planned investments on profits and liquidity.

Introduction

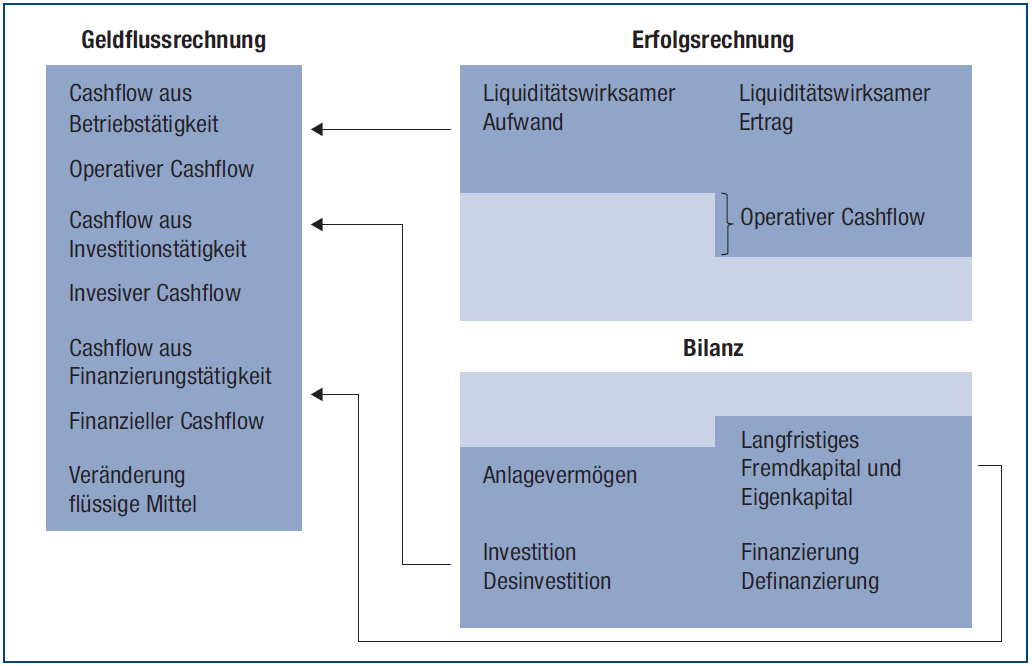

In contrast to the balance sheet and income statement, financial planning does not show the assets, financing and success of a company, but rather depicts the cash flow. Such a cash flow-oriented view is not only required by investors and banks, but also forms the basis for a company valuation. Furthermore, according to the law (Art. 716a CO), financial planning is one of the central tasks of a board of directors. The three instruments of financial planning are interlinked, as shown in Figure 1.

Read the full article from the FOCUS TREUHAND Newsletter 10 | November 2023 here.